Checklist for an

Internal Audit

Muhota Kimotho and

Catholic Relief Services Microfinance

A

BOUT THE

A

UTHOR

Muhota wa Kimotho has a Masters and PhD in Economic Development and Banking from the

University of California, Los Angeles, and holds additional diplomas in Economic Development,

Advanced Credit Analysis, and Banking and Finance from various institutions in the U.S., the U.K.

and Europe. He was a lecturer in Economics, Finance, Money and Banking at the University of

Nairobi, and for 25 years worked for the London-based National Grindlays Bank/Kenya

Commercial Bank Group, eventually serving as Director of the Credit, Business Advisory, and

Legal Services departments. In May 2001, Mr. Kimotho joined Catholic Relief Services (CRS) as

a Senior Technical Advisor for Microfinance, and in 2002 become the CRS Microfinance Regional

Technical Advisor for South East Asia and the Pacific region. Currently he works for UNDP as its

Policy and Technical Advisor for Microfinance and Small and Medium Enterprise Development,

seconded as an Advisor to the Central Bank of Nigeria. Mr. Kimotho is a member of the Financial

Executive Networking Group (FENG), and another writing of his has appeared on the CGAP

Microfinance Gateway.

A

BOUT THE

P

UBLISHERS

Catholic Relief Services (CRS), founded in 1943, assists the poor and disadvantaged outside the

United States. CRS works to alleviate human suffering, promotes the development of people,

and fosters charity, justice, and human dignity in the world. CRS assists the poor solely on the

basis of need, not creed, race or nationality, and maintains strict standards of efficiency and

accountability. CRS currently operates in 99 countries and territories.

CRS Microfinance focuses its services on the poorest clients and on strengthening its partner

organizations that serve them. Its goal is to provide the self-employed poor, especially women,

with access to reliable and permanent financial services. As of December 2004, CRS reaches

over 850,000 microfinance clients in 29 countries in Africa, Asia, Europe, the Middle East, Latin

America and the Caribbean.

A

CKNOWLEDGMENTS

Catholic Relief Services Microfinance gratefully acknowledges the support of the United States

Agency for International Development (USAID) BHR/PVC in the publication and distribution of this

study under CRS/USAID Matching Grant FAO-A-00-99-00054-00. The views expressed in this

case study are those of the author and do not necessarily represent the views of USAID or CRS.

Readers may copy, translate or adapt this book for non-profit use—provided that such copies,

translations or adaptations are distributed free or at cost. Please give appropriate citation credit

to the author, Catholic Relief Services. Comments are welcomed and may be addressed to CRS

or the author at pqsdReques[email protected]g.

Version 1.01

Distributed by:

CATHOLIC RELIEF SERVICES

209 West Fayette Street

Baltimore, MD 21201, USA

www.crs.org

©2005 Catholic Relief Services

Cover photo: Mary Courtney

Ms. Eam Chreb, with a bicycle she purchased with a CRS microfinance loan from Thaneakea

Phum Cambodia to expand her business opportunities.

Final Editor: Ericka Reagor

P

REFACE AND

I

NTRODUCTION

Catholic Relief Services (CRS) is committed to providing dependable, continuous and

sustainable financial services to the poor by offering loan and secure savings

opportunities through community-based microfinance programs.

This

Checklist for an Internal Audit

is intended to assist microfinance institutions (MFIs)

in developing their internal audit capacities. It should be considered a template for

creating a similar checklist more specific to the operations of your particular MFI. It

needs to be adjusted to match the terms and methodology used in your MFI and your

guiding policies and procedures.

An underlying principle highlighted by this document is the need for comprehensive

written institutional policies and procedures to be in place. If those do not already exist,

gaps in policies and procedures can be identified through careful use of this checklist.

Duties and Responsibilities of an Internal Auditor

The duty of an internal auditor is to independently, impartially, and systematically

appraise the operating units and internal controls of an organization. He or she should

have a sound understanding of the systems and procedures of the organization as a

whole, as well as the specific roles and activities of each unit within it, and must be freely

able to communicate with anyone in the organization to obtain information.

An internal auditor determines whether an organization’s documented operating policies

and procedures are easily and clearly understood; whether they are sufficient; whether

they are used effectively and consistently; whether the organization’s management

effectively identifies and minimizes risks; whether staff consistently adhere to written

external regulations and internal policies and procedures; whether gaps in internal

controls or policies and procedures are present; and whether resources are used

efficiently and to the benefit of the organization. Furthermore, it is an internal auditor’s

function is to be directly and actively concerned with detecting and preventing frauds or

forgeries.

Internal auditing utimately is geared toward assisting all members of an organization to

fully understand and effectively perform their duties, and toward the achievement of the

organization’s overall objectives.

On the Use of this Checklist

The format of the checklist is designed to guide the process. Every question must be

answered: the internal auditor should check “yes,” “no,” or “not applicable (N/A)” and

comment accordingly. The comments are especially important inputs for the record,

particularly where the answer is “no.”

The “date” column should reflect the day the item is completed and answered. When the

internal auditor’s inspection and the checklist are complete, he or she will submit it to the

Branch Manager for review. The “Branch Manager initials” column provides space for

the Branch Manager to indicate that he or she has seen each item. It does not indicate

whether the Branch Manager agrees or contends the finding – that information is to be

included in the final Internal Audit Report (as discussed in Appendices C and D).

Some items are marked with either a single (*) or a double (**) star. A “No” answer to a

single-star question calls for urgent remedial action. A “No” answer to a double-star

question denotes a critical situation. For your reference, these items are also listed in

Appendix F.

To the internal auditor:

This checklist cannot substitute for a sound understanding of

auditing tasks and protocol, nor reduce your responsibility for thoroughness. It serves as

a guide, intended to help organize the audit process and to aid your memory. This

checklist is not exhaustive, and the audit team should review and update it regularly,

based on lessons learned.

Reporting the Results of an Internal Audit

An internal auditor should report directly to the Board of Directors and not to the Director

or the senior management of the MFI. Since the audit findings may concern

management at various levels, reporting to the same persons would create a potential

conflict of interests. The audit report itself should be written in such a way that the

identity of all contributors to the findings is protected. Otherwise, it will be increasingly

difficult for the auditor to gather sensitive, critical information in future audits. Finally an

individual should never serve as an internal auditor for a unit(s) for which he or she has

any direct operational or managerial responsibility.

T

ABLE OF

C

ONTENTS

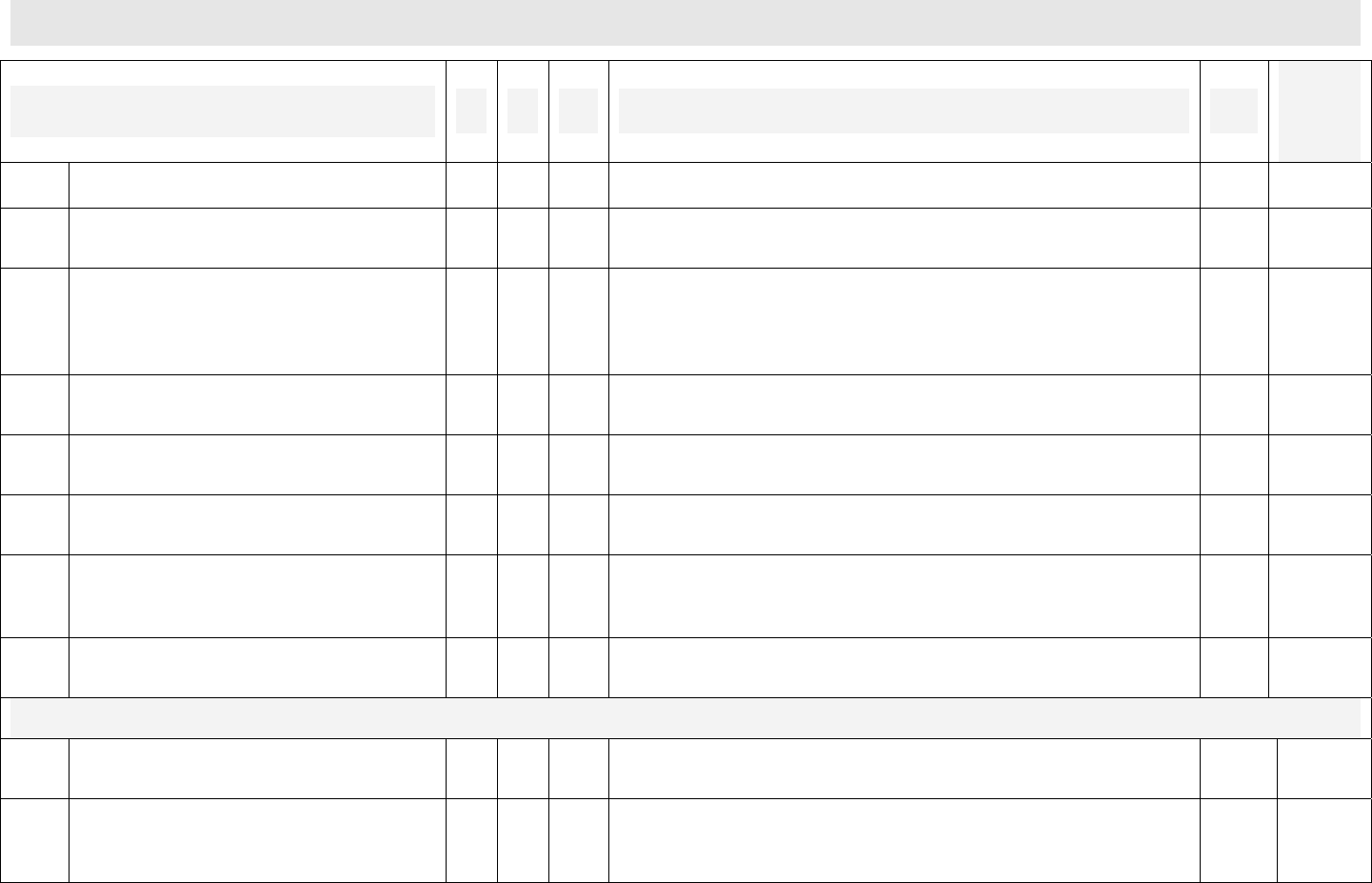

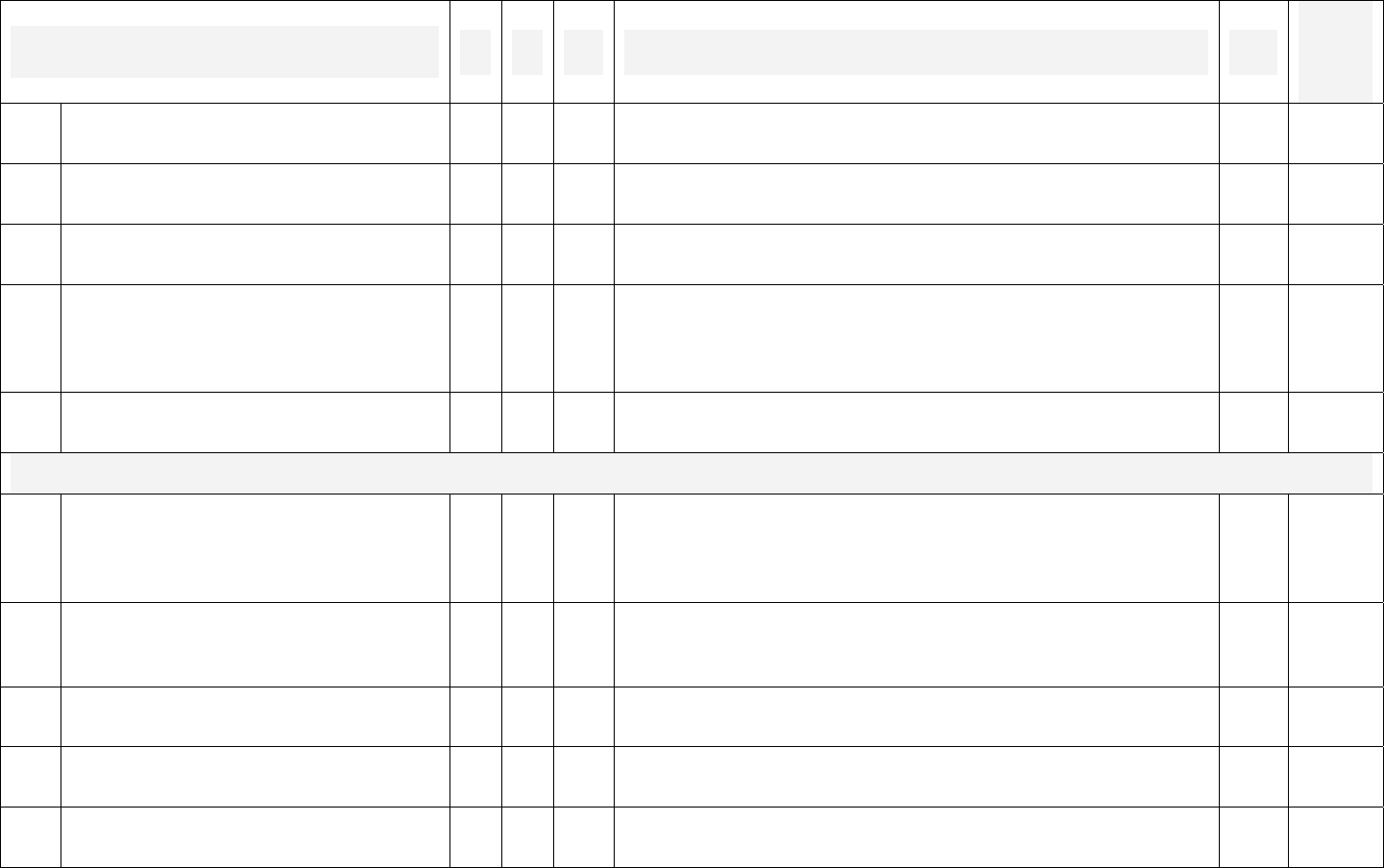

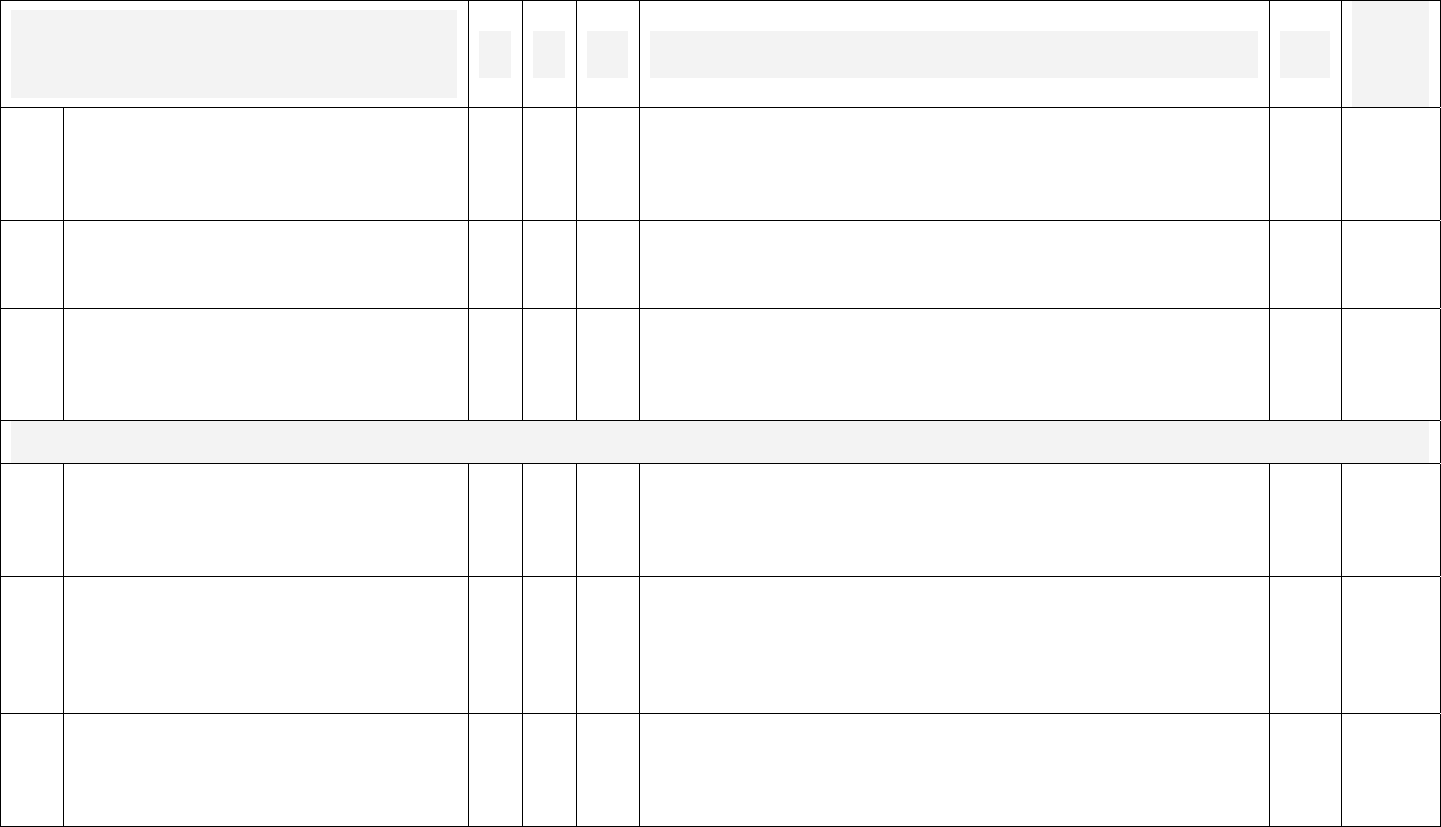

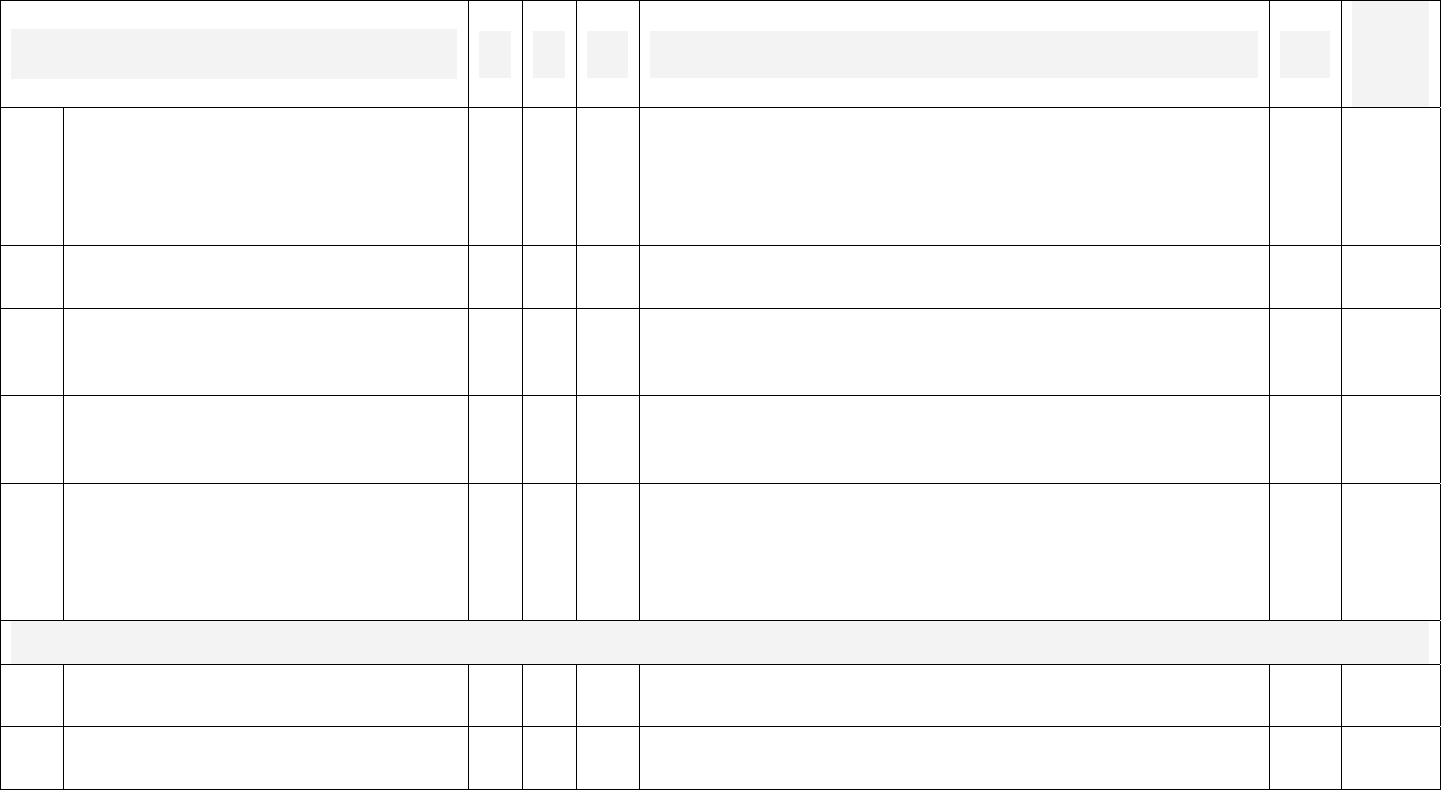

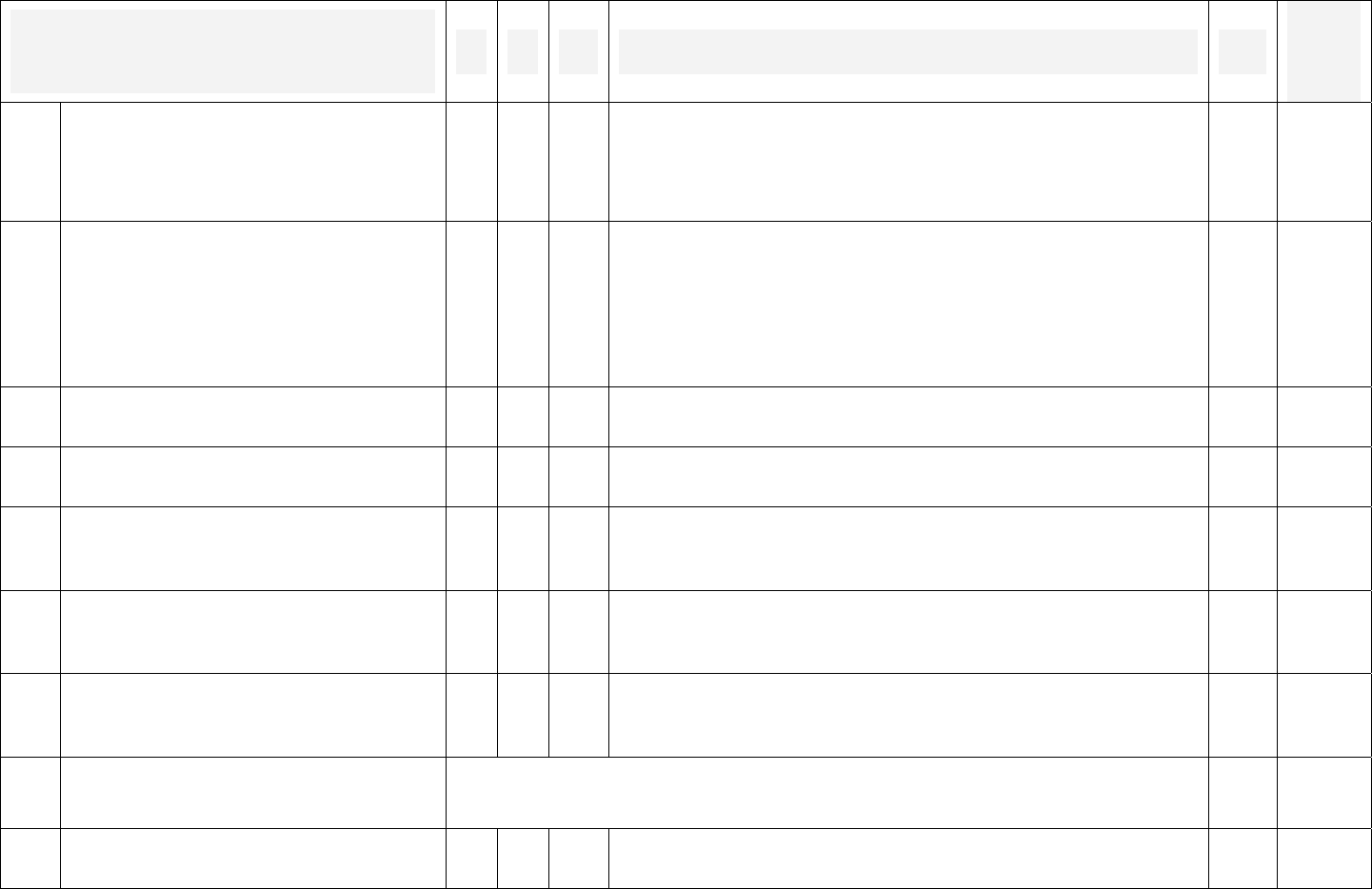

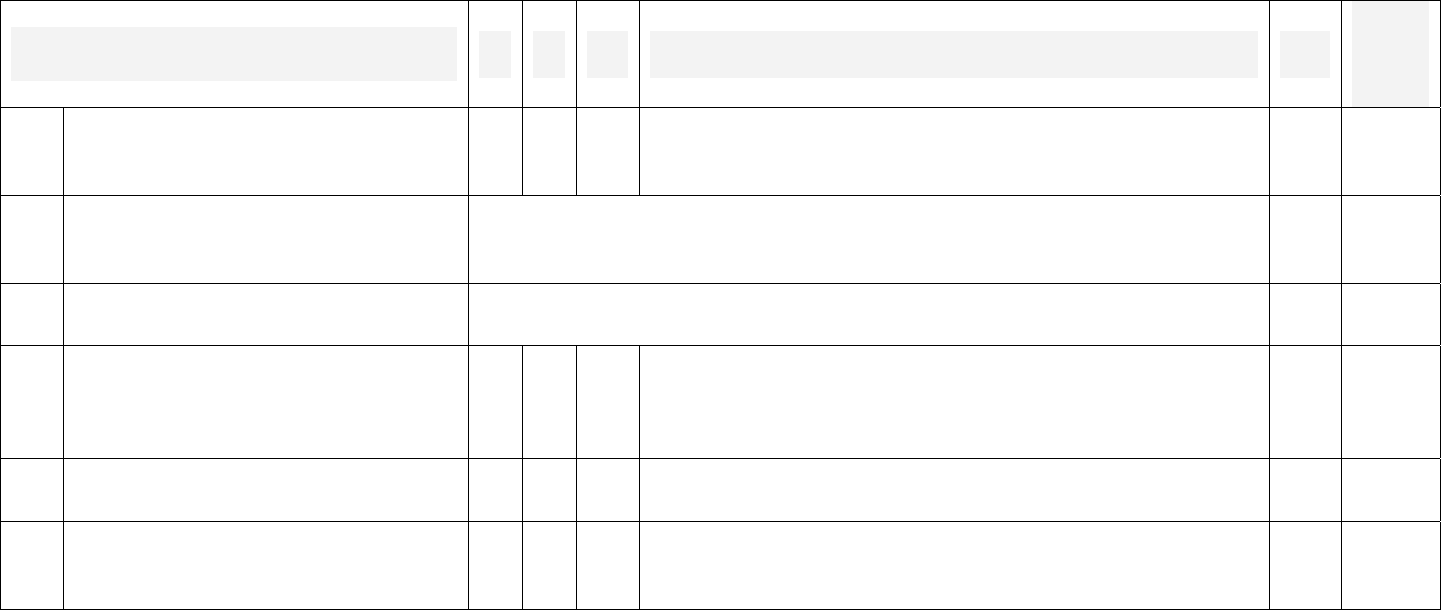

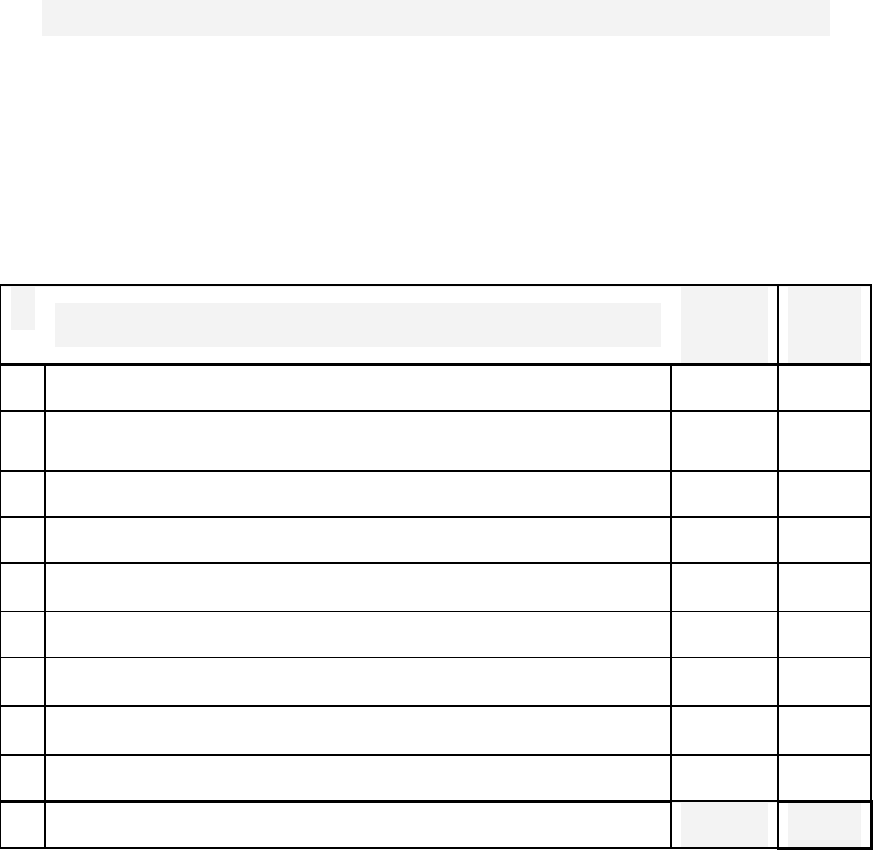

Audit Area Checklist Numbers Page

Building and Premises 1-8 1

Safe 9-18 1

Cash Records 19-29 2

Appearance 30-34 4

Fixed Assets 35-47 4

Office Supplies 48-53 5

Operations Manual 54-58 6

General Ledger, Vouchers and Payments 59-69 7

Loan Disbursement 70-77 8

Loan Reimbursement 78-95 10

Monitoring Revenue and Income 96-97 12

Accrued Interest Recievable and Client Loan Records 98-117 13

Staff Discipline, Morale, Resignation and Training 118-132 15

Payroll 133-135 17

Sick and Annual Leave Records 136-138 18

Medical Coverage 139-144 18

Operational Weaknesses 145 19

Expenses 146-148 19

Frauds and Forgeries 149 19

Other Observations 150-155 20

Check on Major Balance Sheet Headings (table) 156-159 21

Important Ratios (table) 160 22

L

IST OF

A

PPENDICES

Appendix Page

A

B

C

D

E

F

Daily Cash Check and Reconciliation Procedures for Managers

Internal Controls

Credit Inspection Internal Audit Report

Financial Services Internal Audit Report

Job Description for an Internal Auditor

Single- and Double-Starred Checklist Items

23

27

31

33

35

37

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

1

Branch Name: Date:

B

UILDING AND

P

REMISES

Y N N/A Comments Date

Branch

Manager

Initials

1

Is the branch easy to locate?

2

Are natural disasters rare at the

location?

3

Is the building secure against crime?

(Does it have permanent, solid walls,

ceiling and floors; is it located in a low

crime district?)

4

Is the gate locked overnight, with

adequate security personnel on site?

5*

Are all doors and windows well

secured to prohibit forced entry?

6*

Are at least two different keys required

to unlock the building’s doors?

7**

Are at least two different keys required

to unlock the strong room (safe room)

door?

8*

Is the strong room secured to prohibit

forced entry?

S

AFE

9*

Is the safe fixed to the wall or floor to

prevent its removal?

10**

Do safe custodians issue receipts for

all cash received, and are copies of

those kept in the safe?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

2

SAFE, continued

Y N N/A Comments Date

Branch

Manager

Initials

11**

Are all changes of custodian for safe

key and combination, and the date

and time of each change, recorded in

a register?

12**

Are the safe key and combination held

separately at all times by senior staff?

13**

Do outgoing and incoming safe

custodians sign next to the change

entries?

14*

Do duplicate safe keys and

combinations exist?

15*

Are there written procedures to

access the duplicates?

16*

Are receipts kept whenever duplicate

keys or combinations leave or enter

the safe?

17**

Is more than one custodian present

when the safe is opened?

18**

Before the safe is opened, are the

main door and the door to the strong

room locked?

C

ASH

R

ECORDS

19**

Are all cash movements to and from

the safe recorded in a cashbook?

20**

Are entries in the cashbook and on

receipts recorded in both numbers

and words?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

3

CASH RECORDS, continued

Y N N/A Comments Date

Branch

Manager

Initials

21**

Do the figures and words in all entries

agree?

22

Are receipts for cash received into the

safe prepared in triplicate?

Does the final copy remain in the

receipt book?

23

Are the receipts in the receipt book in

ascending numerical order?

24*

When a receipt is cancelled, are all

three copies left in the receipt book?

25

Is all cash in the safe arranged by

denomination, appropriately sealed,

and the amount labeled on each

bundle?

26**

Does the total cash count reconcile

with the recorded total in the

cashbook, the cash journal and in the

daily cash position register?

27

Is the branch cash limit in writing?

28*

Is the branch cash limit observed?

29*

Did you undertake a random check of

at least 50% of all cash transactions in

the cashbook to confirm that the

entries are correct?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

4

A

PPEARANCE

Y N N/A Comments Date

Branch

Manager

Initials

30

Are receipts stamped with the branch

logo?

31

Does the staff look professional and

portray a good image?

32

Do the branch’s services adequately

meet client needs?

33

Does the Branch Manager hold

meetings with each Credit Agent

before he or she goes out to the field

and when he or she returns?

34

Are the stipulated working hours strictly

observed?

F

IXED

A

SSETS

35

Do the fixed assets (computers, desks,

filing cabinets, etc.) correspond with

what is listed in the branch’s printed

inventory?

36

Apart from normal wear-and-tear, are

the furniture, equipment and machines

well protected and in good condition?

37

Are the Credit Agents’ motorbikes and

keys left at the branch overnight?

38

Is a fuel log maintained to record all

fuel purchases?

39

Do the Credit Agents wear helmets at

all times while driving?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

5

FIXED ASSETS, continued

Y N N/A Comments Date

Branch

Manager

Initials

40

Do all fixed assets have a Fixed Asset

Number clearly written on them in

indelible ink?

41

Are all computers, printers and

keyboards covered to protect them

when not in use?

42

Are all business visit destinations,

mileages and times of departure and

return recorded?

43

Do branch vehicles carry only

employees and Management

Committee members?

44

Are the vehicles cleaned regularly and

in good condition?

45

Are major defects to vehicles or

motorbikes repaired immediately?

46*

Are all vehicles and motorbikes fully

insured and licensed?

47

Are repair bills for vehicles and

motorbikes reasonable, taking into

account the age of the machines?

O

FFICE

S

UPPLIES

48

Does one employee manage the

ordering, control, storage and

disbursement of office supplies?

49

Are “re-order point” slips utilized, to

prompt the reorder of supplies?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

6

OFFICE SUPPLIES, continued

Y N N/A Comments Date

Branch

Manager

Initials

50

Upon receiving items, does the supply

manager check that the items received

match the order invoice?

51

Are supplies kept locked?

52

Do department heads sign for

departmental stationery orders?

53

Does the Branch Manager ensure that

stocks are maintained at reasonable

but not excessive levels?

O

PERATIONS

M

ANUALS

54

Does the Branch Manager keep master

copies of the operations and

administrative manuals?

55

Are all sections of the operations

manual present and in the correct

order in the binder, and is the index up

to date?

56

Does each staff member have a copy

of the section that relates directly to his

or her job?

57

Do all employees understand the

sections relevant to their jobs?

58

Do all departments abide by the

operations manual?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

7

G

ENERAL

L

EDGER

,

P

AYMENTS

V

OUCHERS AND

Y N N/A Comments Date

Branch

Manager

Initials

59

Is one employee designated to daily

verify all voucher entries to ensure

details are posted correctly to the

accounts?

60

Does he or she check the “brought

forward” and “carried forward” debit

and credit figures to ensure they are

correct?

61

Does the manager daily personally

scrutinize each balance in the ledgers

to ensure that the correct account

balances are reflected?

62

Is one employee designated to ensure

that all general subsidiary ledger

vouchers are fully completed?

63

Have all vouchers been approved and

initialed or signed, as needed, by all

parties?

64

When bills are paid in cash, is a receipt

issued for the amount?

65

Are full details recorded on vouchers

for branch expenses to any account

(including prepaid expenses)?

66

Are all “paid” vouchers cancelled or

perforated immediately after posting to

prevent their re-use?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

8

GENERAL LEDGER, VOUCHERS AND PAYMENTS,

continued

Y N N/A Comments Date

Branch

Manager

Initials

67

Where debit vouchers are raised above

the limit of the Branch Manager’s

authority, is the amount within his or

her branch budget?

68

Are all cash advances paid to out-of-

office staff properly authorized and not

excessive?

69

Are all previous cash advances

resolved within five days of an

employee’s return to the office, and

before a new cash advance is

g

ranted?

L

OAN

D

ISBURSEMENT

70

Do all loan applications have the

signature or thumbprint of the

borrower, and have the borrower’s

photograph attached?

71

Do Credit Agents submit loan

agreements, loan application forms,

journals and signed reports five

working days before a disbursement

date?

72

Do both the Credit Manager and

Branch Manager approve all loan

documents before the Cashier releases

cash?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

9

LOAN DISBURSEMENT, continued

Y N N/A Comments Date

Branch

Manager

Initials

73

Does the Cashier initial against the

signature of the Credit Agent, the

Credit Manager and the Branch

Manager on all loan approvals before

releasing cash for disbursement?

74

Does the Cashier prepare each loan

disbursement voucher in triplicate?

75

Do the Credit Agent, Credit Manager,

Branch Manager and Cashier sign

each voucher?

76

Does the Cashier keep the last copy,

and give the original and first copies to

the Credit Agent?

77

If a Credit Agent does not disburse the

total cash for loans:

a. Are the amounts on individual loan

agreements amended to reflect

the actual cash amount disbursed,

and then signed by the Credit

Agent, the Management

Committee Treasurer and

Secretary, and the client?

b. Is the disbursement voucher

amended to reflect the correct

amount disbursed, and is it signed

by the Credit Agent and the

Management Committee

Treasurer, Secretary and

President?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

10

L

OAN

R

EIMBURSEMENT

Y N N/A Comments Date

Branch

Manager

Initials

78

Do member names and numbers, the

total number of members, and the

amounts borrowed, as recorded on

individual loan agreements, match the

data recorded in the Credit Agent’s

journal?

79

Do the Management Committee

Treasurer and Secretary always sign

where required in the Credit Agent’s

journal?

80

Does the Treasurer always count the

cash handed to her by the President to

confirm that the amount collected is

what is due?

81

Is cash received at the Village Bank

arranged by denomination?

82

Does the Credit Agent issue a receipt

to the Management Committee

President for the total amount of cash

received, and do both sign the receipt

to confirm it?

83

Do the Credit Manager and the Branch

Manager daily record the amount of

cash they should receive from each

Credit Agent that day?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

11

LOAN REIMBURSEMENT, continued

Y N N/A Comments Date

Branch

Manager

Initials

84

Do the Credit and Branch Managers

confirm that the cash received by a

Credit Agent from a Village Bank is

recorded in the Credit Agent’s journal

and on the receipt, and that the

amounts agree?

85

Does the Cashier accept cash from the

Credit Agents only after the Credit and

Branch Managers initial the Credit

Agent’s journal and the receipt?

86

After the Cashier counts the cash and

finds the amount correct, does she or

he issue an official receipt to the Credit

Agent showing the amount in words

and figures?

87

Is cash received lodged in the safe

immediately after counting?

88

Does the Bookkeeper update the

cashbook, the cash ledger and the

daily cash position daily before

leaving?

89

Do separate staff members perform

cashiering and accounting functions?

90

Does the Branch Manager ensure that

the Cashier does not have access to

the accounting records, especially

those related to cash transactions?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

12

LOAN REIMBURSEMENT, continued

Y N N/A Comments Date

Branch

Manager

Initials

91

At the end of each working day, does

the Branch Manager verify and

reconcile all daily entries and closing

balances in the cashbook, cash ledger

and daily cash position?

92

Is action on loans in arrears prompt

and continuous?

93

Do two Credit Agents go to collect

arrears, to avoid potential one-to-one

disagreements with a client?

94

Does the Branch Manager verify

arrears by personally visiting clients in

default?

95

Is the amount of cash from arrears

collected recorded in the Credit Agent’s

journal, and is that amount handed

over to the Cashier on the same day it

is collected?

M

ONITORING

R

EVENUE AND

I

NCOME

96

Does the Branch Manager reconcile all

entries to the interest-earned account?

97

Is a register or passbook maintained to

record all interest earned?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

13

A

CCRUED

I

NTEREST

R

ECEIVABLE AND

C

LIENT

L

OAN

R

ECORDS

Y N N/A Comments Date

Branch

Manager

Initials

98

Does the number of outstanding loans

upon the date of this audit agree with

the number shown on the latest return

submitted to Head Office?

99

Does the total value of the current

outstanding loans agree with the value

shown on the latest return submitted to

Head Office?

100

Is the number of loans outstanding

equal to or less than the number of the

branch’s clients?

101

Do all loans outstanding meet the

branch’s lending criteria? Have all of

them been acknowledged by the

Branch Manager?

102

In all cases, are interest rates on loans

calculated correctly?

103

Did you ascertain, by doing a sample

check, that all the loans granted by the

branch are to genuine identities?

104

Did you verify, by doing a sample

check, that there were no loans

granted by proxy?

105

What is the number and value of loans

in arrears? (A loan is considered to be

in arrears one day after it is due for

repayment.)

(Please list)

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

14

ACCRUED INTEREST RECEIVABLE AND CLIENT

LOAN RECORDS, continued

Y N N/A Comments Date

Branch

Manager

Initials

106

What is the number and value of loans

considered “portfolios at risk”? A loan

is considered at risk immediately after

repayment falls into arrears.

(Please list)

107

What is the number and value of loans

written-off? A loan is written-off if it is

90 days in arrears.

(Please list)

108

Is Head Office approval obtained

before all write-offs?

109

Do the calculations for loans in arrears,

for portfolios at risk, and for loans

written-off correspond with the

numbers reported on the latest return

submitted to Head Office?

110

Did you undertake at least a 50%

random check to confirm that all clients

have only one loan?

111

What is the growth rate of number and

value of loans over the last two

quarters?

(Please list)

112

Do your growth rate calculations

(above) agree with those reported by

the branch?

113

Is cash received by loan repayments

handed over to the Cashier on the

same day it is received?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

15

ACCRUED INTEREST RECEIVABLE AND CLIENT

LOAN RECORDS, continued

Y N N/A Comments Date

Branch

Manager

Initials

114

Did you undertake a random check on

at least 25% of all loans to determine

whether the interest collected is

correct?

115

Did you undertake a random check on

at least 10% of all portfolios to

determine whether interest due to the

branch been collected and credited to

the appropriate revenue account?

116

Are detailed files maintained for each

client?

117

Are clients who have dropped out

recorded in the register, listing the full

name, passbook number, name of the

Village Bank and the reason for

leaving?

S

TAFF

D

ISCIPLINE

,

M

ORALE

,

R

ESIGNATION AND

T

RAINING

118

List staff actually seen during this audit by title and number of individuals in that role:

Title (Number of Persons) Title (Number of Persons)

Branch Manager _____

Credit Manager _____

Credit Agent _____

Bookkeeper _____

Cashier _____

T

OTAL number of staff seen: _____

119

Does the total number of staff actually

seen agree with Head Office’s record

for staff for the branch?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

16

STAFF DISCIPLINE, MORALE,

TRAINING, continued

R

ESIGNATION AND

Y N N/A Comments Date

Branch

Manager

Initials

120

In your opinion, is the number of staff

currently appropriate?

If not, which positions should be

reduced or augmented?

121

Do you consider all staff to be well

trained in performing their job

functions?

If not, which individuals require

attention, and what training do you

recommend?

122

Is the branch’s on-the-job training

adequate?

123

Are all staff utilized to their full

capacity?

124

In case of unexpected absence, are

there alternate individuals on staff to

fulfill the work?

125

Do the performance evaluations on file

accurately reflect individual employees’

performances?

126

Do the management’s interactions and

relationships with staff encourage

participation and commitment?

127

Is the Branch Manager effective?

(Please comment)

128

Do Credit Agents report to Village Bank

meetings on time?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

17

STAFF DISCIPLINE, MORALE, RESIGNATION AND

TRAINING, continued

Y N N/A Comments Date

Branch

Manager

Initials

129

Are Credit Agents rotated to avoid

collusion?

130

Does the Credit Manager regularly

undertake visits to the Village Banks to

get feedback from clients on how their

needs are being met?

131

How would you describe staff morale at

the branch?

(Please comment)

132

Is high staff turnover a concern at the

branch?

If yes, what are frequent causes for

resignation?

P

AYROLL

133

Does the total monthly debit listed on

the master payroll voucher agree with

the monthly amount debited to the staff

emoluments account?

134

Does the financial controller initial all

alterations or cancellations to the

master payroll voucher?

135

Are contra entries on the total payroll

debit transferred correctly to the

*

appropriate account?

*

For example, are leave allowances and recoveries for advances reversed to credit the prepaid expenses account?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

18

S

ICK AND

A

NNUAL

L

EAVE

R

ECORDS

Y N N/A Comments Date

Branch

Manager

Initials

136

Are all staff sick and annual leave

absences recorded?

137

Does the branch maintain a leave

roster?

138

Is the staff leave roster kept up-to-

date?

M

EDICAL

C

OVERAGE

139

Are all staff medical claims recorded?

140

Are sufficient details of an employee’s

family -- spouse’s full name, number of

children, marriage and birth certificates

– included with all medical claims?

141

Are claim forms always signed by the

employee submitting the claim?

142

Is an original doctor’s, laboratory or

pharmacy receipt always attached to

medical claim form?

a

143

Does the CEO or COO at Head Office,

as well as the Branch Manager, sign all

medical claim reimbursements?

144

Is the stipulated maximum for medical

claim expenses per employee, per

year, strictly observed?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

19

O

PERATIONAL

W

EAKNESSES

Y N N/A Comments Date

Branch

Manager

Initials

145

In your opinion, are there any

operational weaknesses at this

branch?

If so, what are they and how could they

be addressed?

E

XPENSES

146

Are costs effectively controlled?

(Please comment)

147

Are all costs approved by Head Office?

148

Did you note any unauthorized

expenses? If so, give full details.

F

RAUDS AND

F

ORGERIES

149

Have there been any frauds or

forgeries at the branch?

If so, were they reported to Head

Office?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

20

O

THER

O

BSERVATIONS

Y N N/A Comments Date

Branch

Manager

Initials

150

Has all revenue due to the branch

been collected and credited to the

appropriate revenue account?

151

Are the branch’s marketing, business

development and relationships with

clients good and effective?

(Please comment)

152

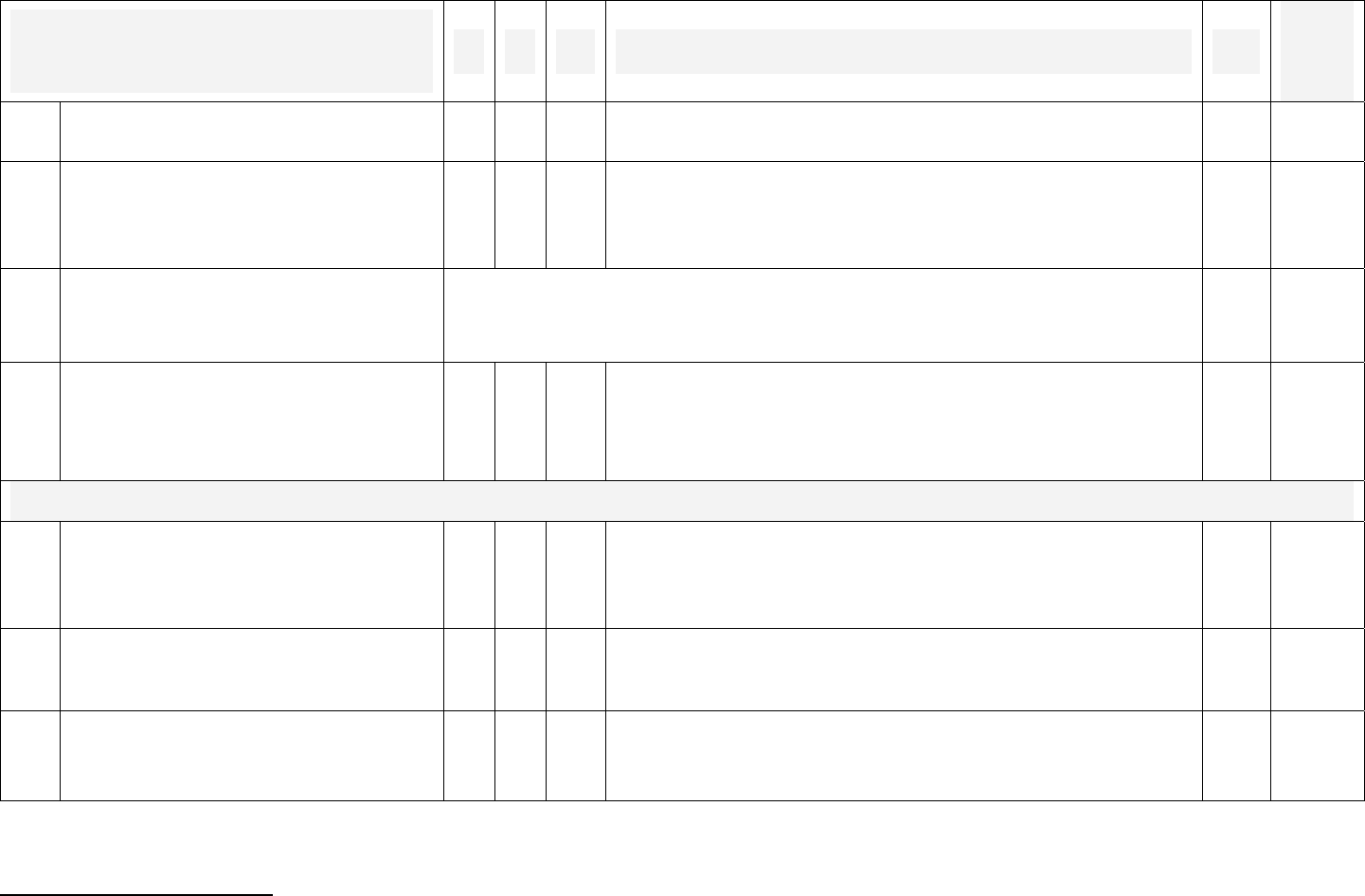

Who are the new competitors in the

area?

(Please list)

153

Are the branch’s privileged records – for

example loan and staff files – locked in

a fire-proof cabinet to which only

authorized personnel can gain access?

154

Are all files withdrawn recorded to

ensure their return?

155

Are records kept in good condition and

in an orderly manner, to facilitate their

easy retrieval?

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

21

C

HECK ON

M

AJOR

B

ALANCE

S

HEET

H

EADINGS

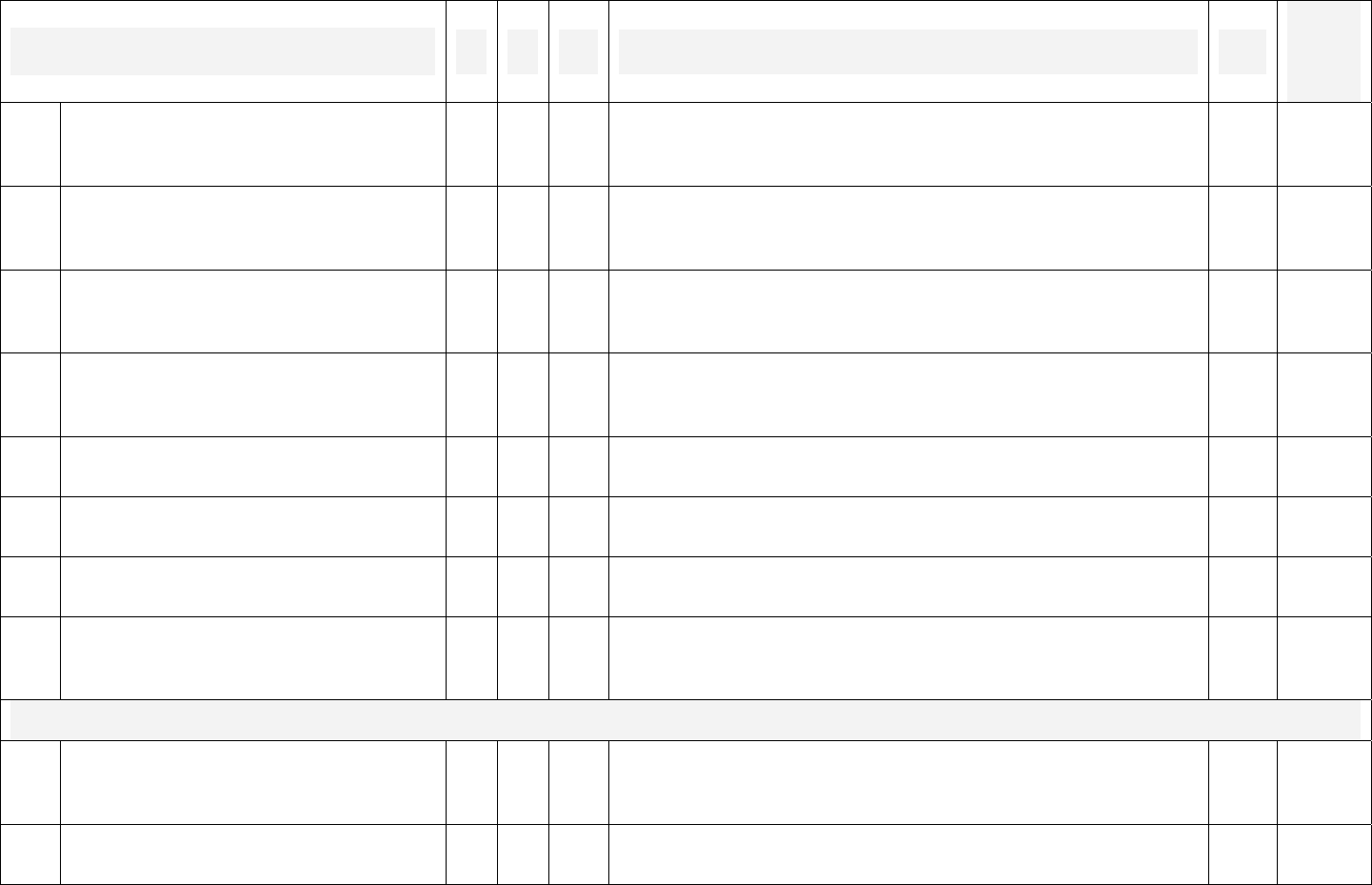

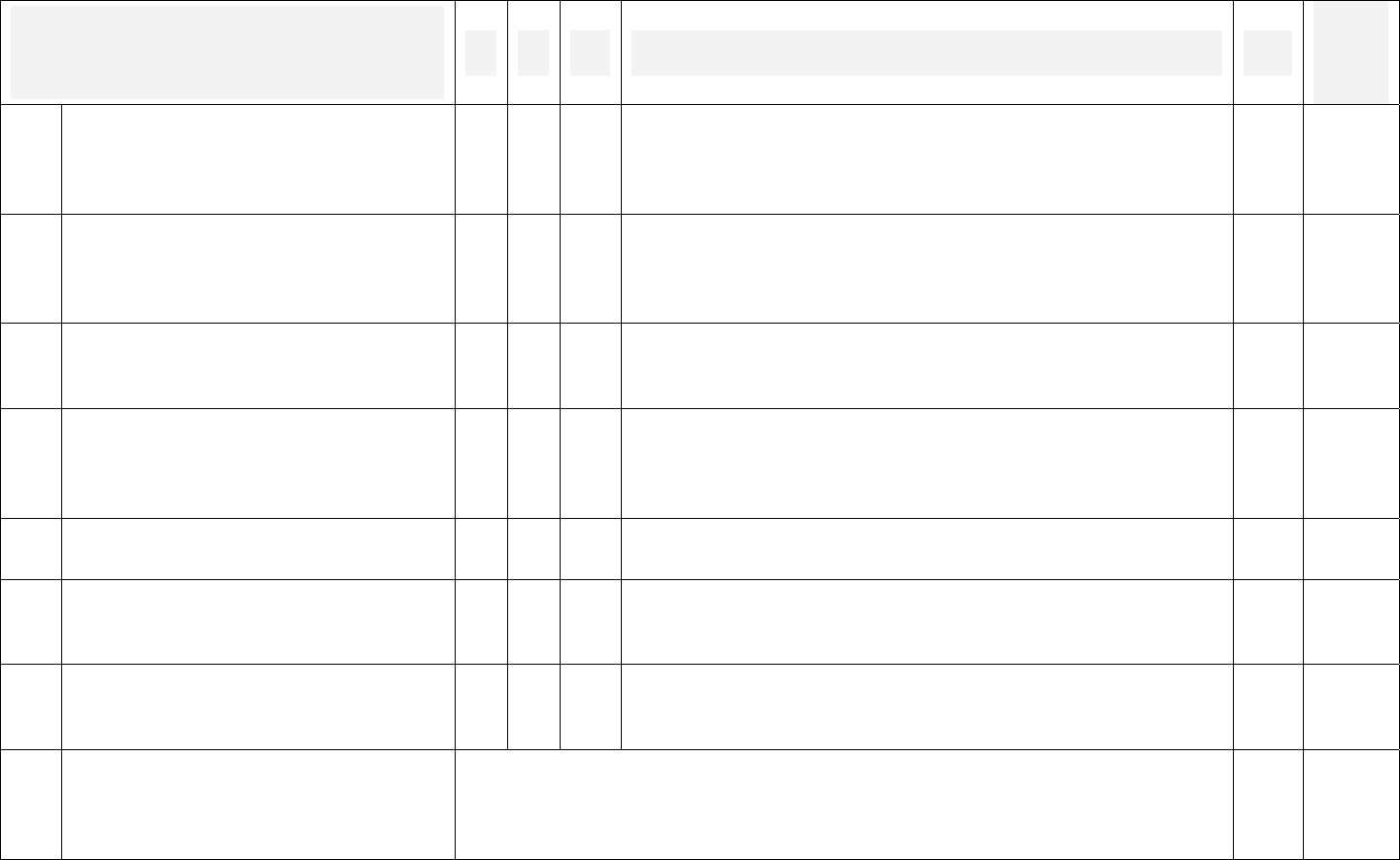

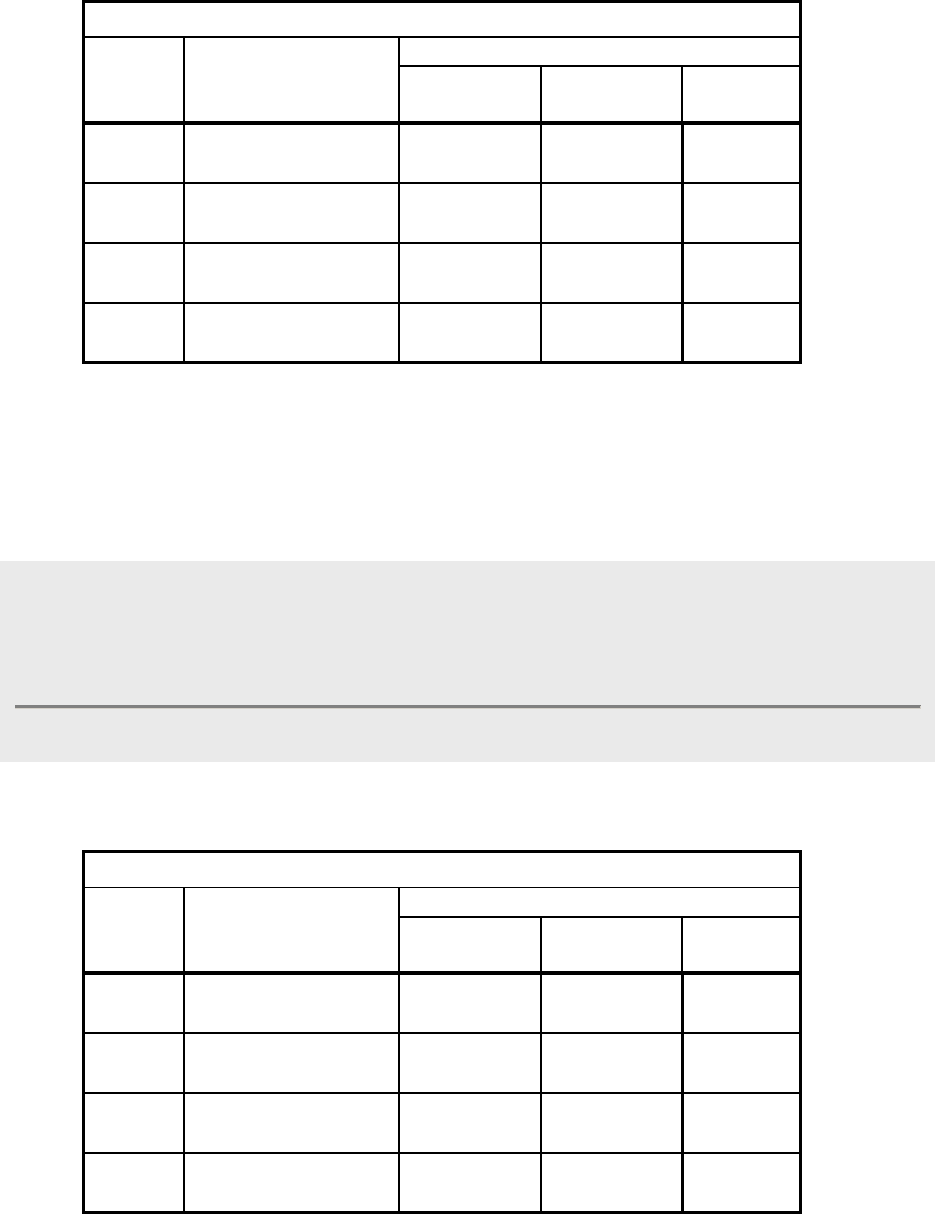

156

N

UMBER OF LOANS (CLIENTS) LOAN AMOUNT

V

ARIANCE

Last Audit This Audit Last Audit This Audit

Loans (Assets)

Savings (Liabilities)

157

B

UDGETED ACTUAL ACHIEVEMENT (%) VARIANCE

Operating Revenue

Less: Operating Costs

Operating Surplus

158

L

AST YEAR BUDGET THIS YEAR ACTUAL THIS YEAR VARIANCE

Operating Revenue

Less: Operating Costs

Operating Surplus

159

A

MOUNT LAST AUDIT AMOUNT THIS AUDIT VARIANCE

Frauds and Forgeries

Provision for Bad and Doubtful Debts

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

22

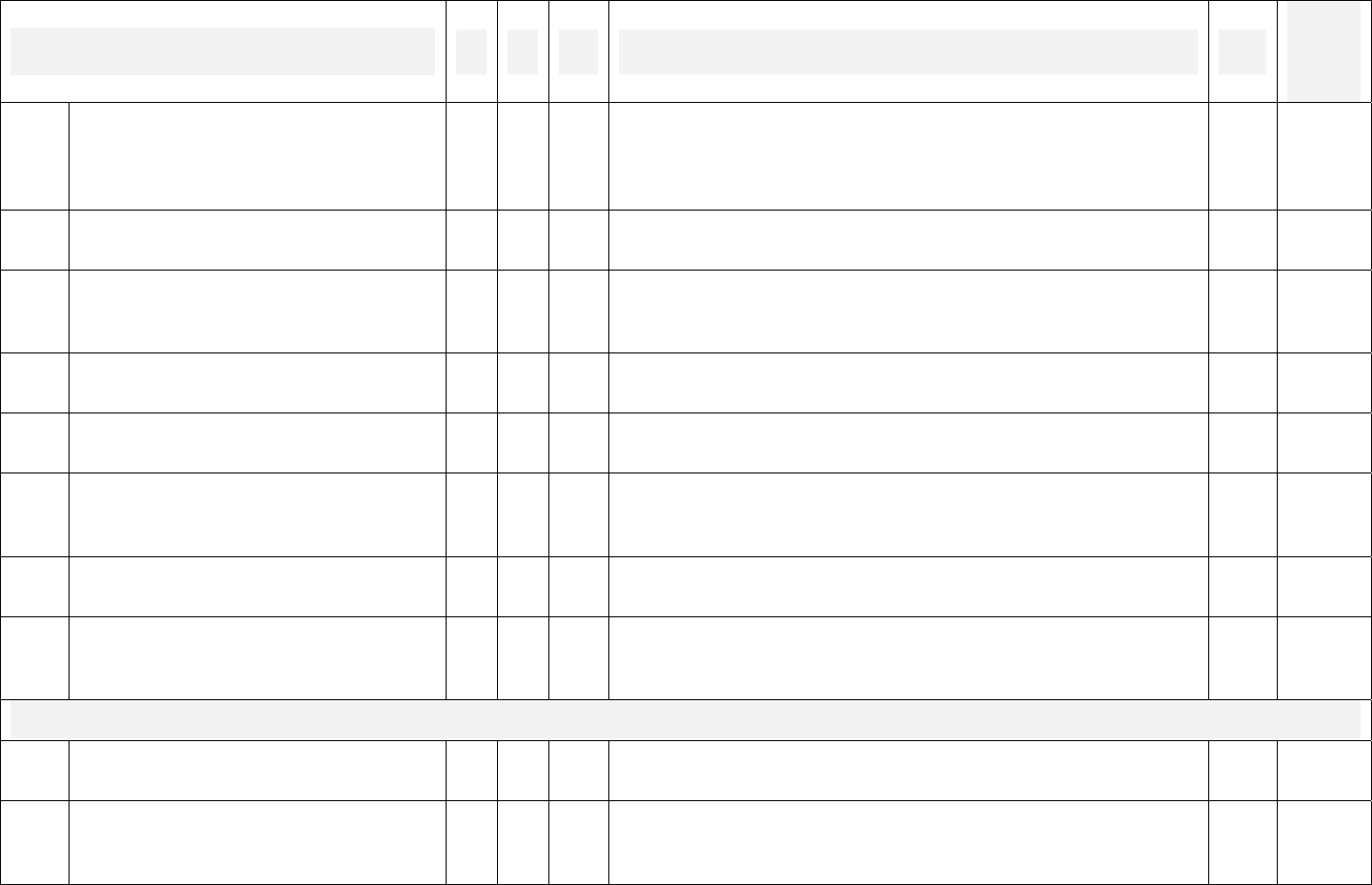

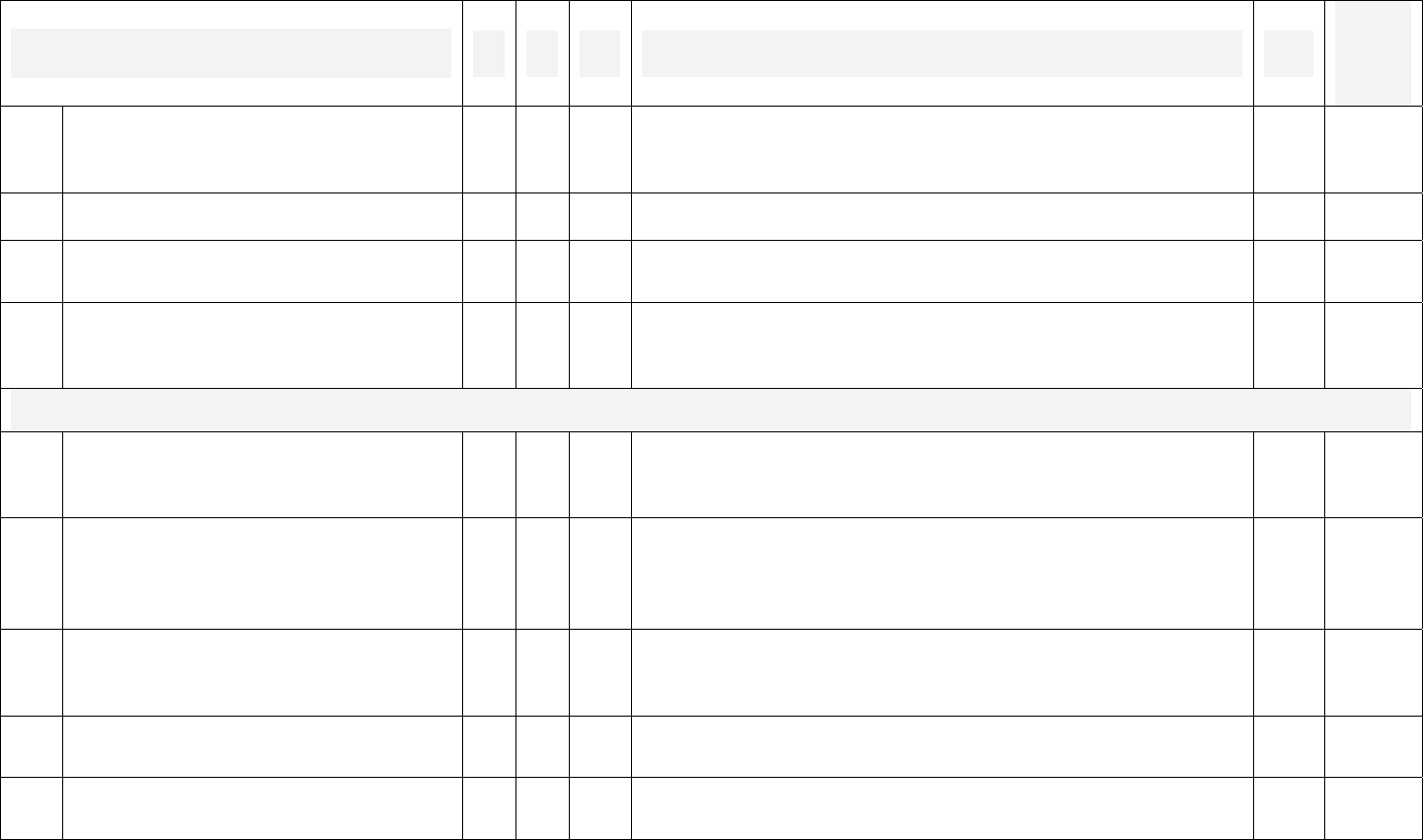

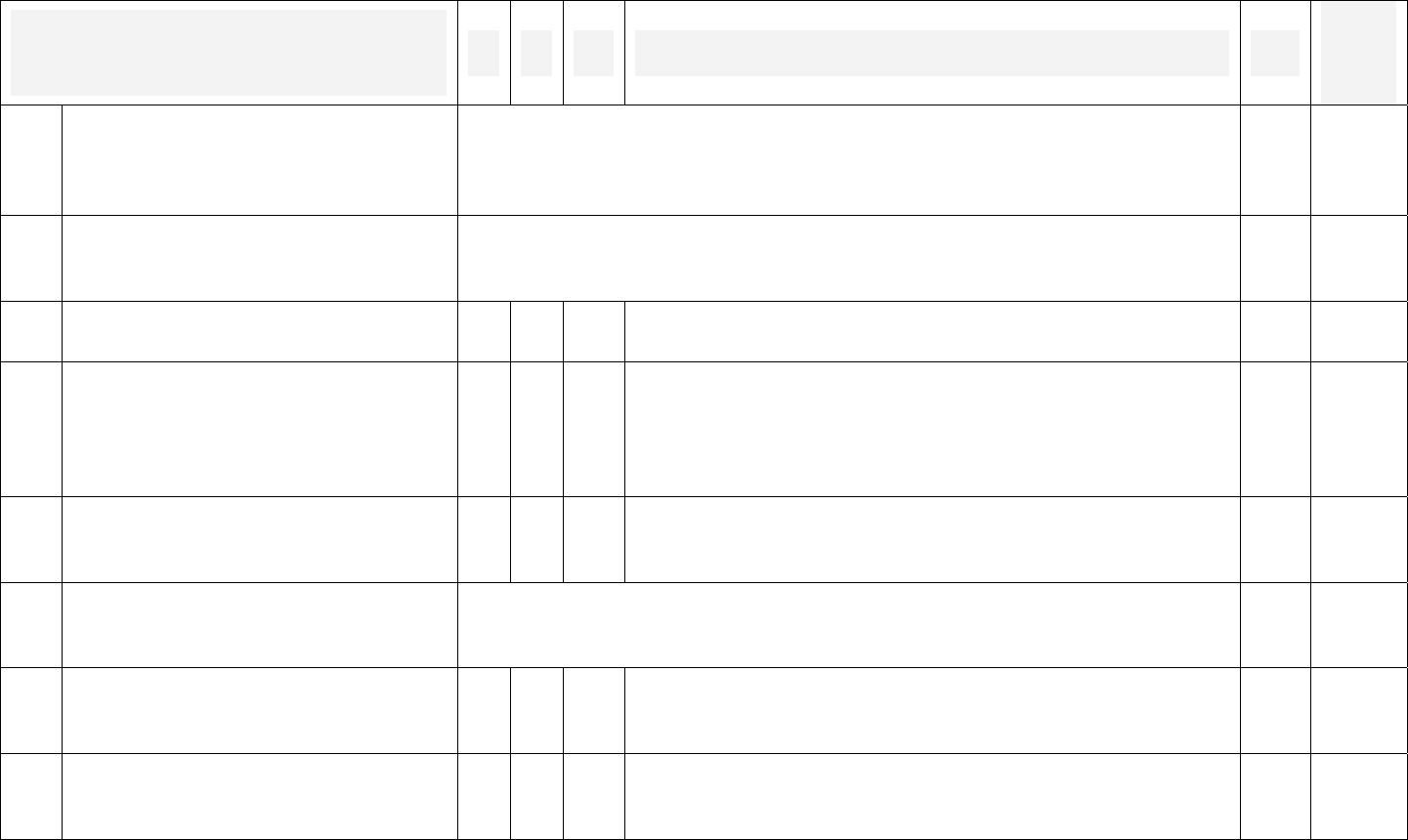

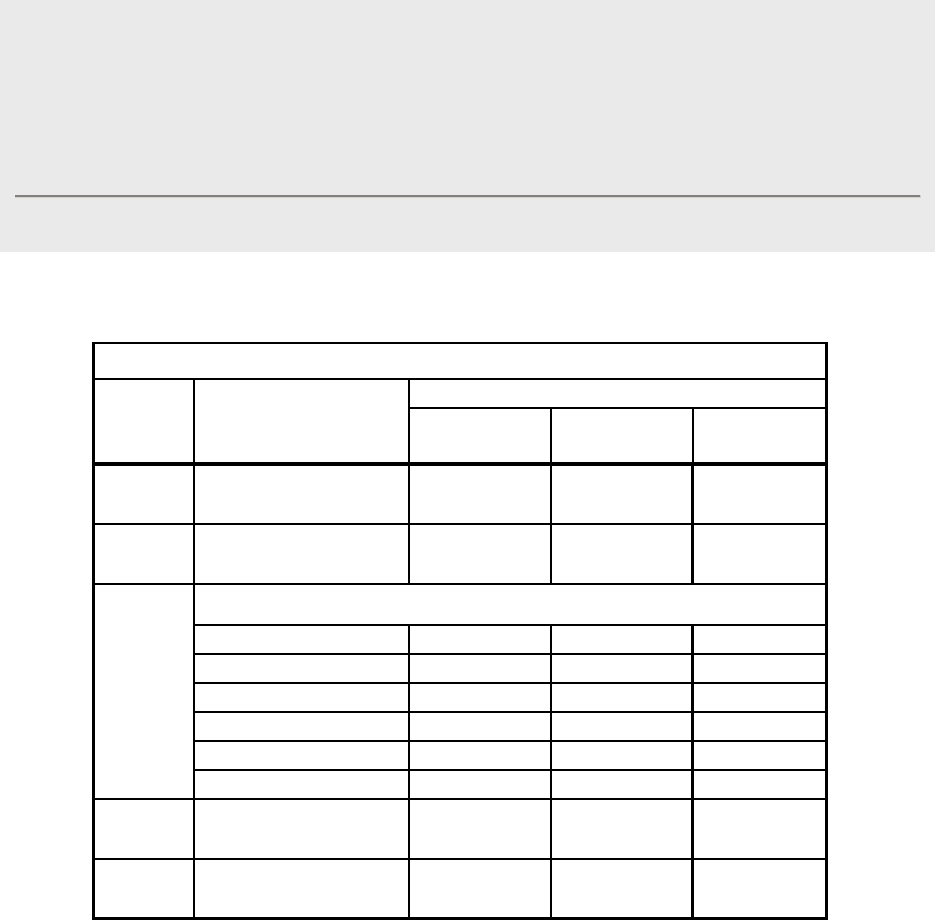

I

MPORTANT

R

ATIOS

160

R

ATIO

C

ALCULATION

L

AST

Y

EAR

T

HIS

Y

EAR

Cost Per Unit

Operating costs

Total portfolio

Loan Officer

Productivity

Number of active loans

Number of loan officers

Number of active clients

*

at beginning of period

Client Drop-out or

Increase

+ Number of new clients during the period

- Number of active clients at the end of the period

+

-

+

-

(=) Number of active clients at the end of the period

Staff Turnover

Number of staff who left

Average number of staff

Loans in Arrears

Loans in arrears

Total portfolio

Portfolios at Risk

Amount in arrears in the past 60 days

Total portfolio

Loan Loss Ratio

Loans written-off

Average Portfolio

Increase in Portfolio

(Ending portfolio - beginning portfolio)

Beginning portfolio

Increase in Savings

(Ending savings - beginning savings)

Beginning savings

* An “active client” is one with an outstanding loan during the period, which is not in arrears.

Appendix A

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

23

D

AILY

C

ASH

C

HECK AND

R

ECONCILIATION

P

ROCEDURES

FOR

B

RANCH AND

C

REDIT

M

ANAGERS

A Branch Manager i

s required to verify and reconcile the total cash on hand in three

separate records at the close of every working day. He or she checks all entries in the

Cash Book, the Cash Ledger and the Daily Cash Position, and then initials the recorded

total cash on hand for that day in each, if correct. The Branch Manager should use a

pen, preferably red, that is different in color from the one used to make the entries.

The Credit Manager, or next most senior person under the Branch Manager, is required

to weekly verify and reconcile the cash on hand in the same three documents. The

Credit Manager should also do so with a distinct pen color.

To begin each new business day, “yesterday’s” cash on hand is carried forward to

“today,” and becomes the day’s starting cash on hand. The amount is entered into the

cash records as “brought forward” (B/F).

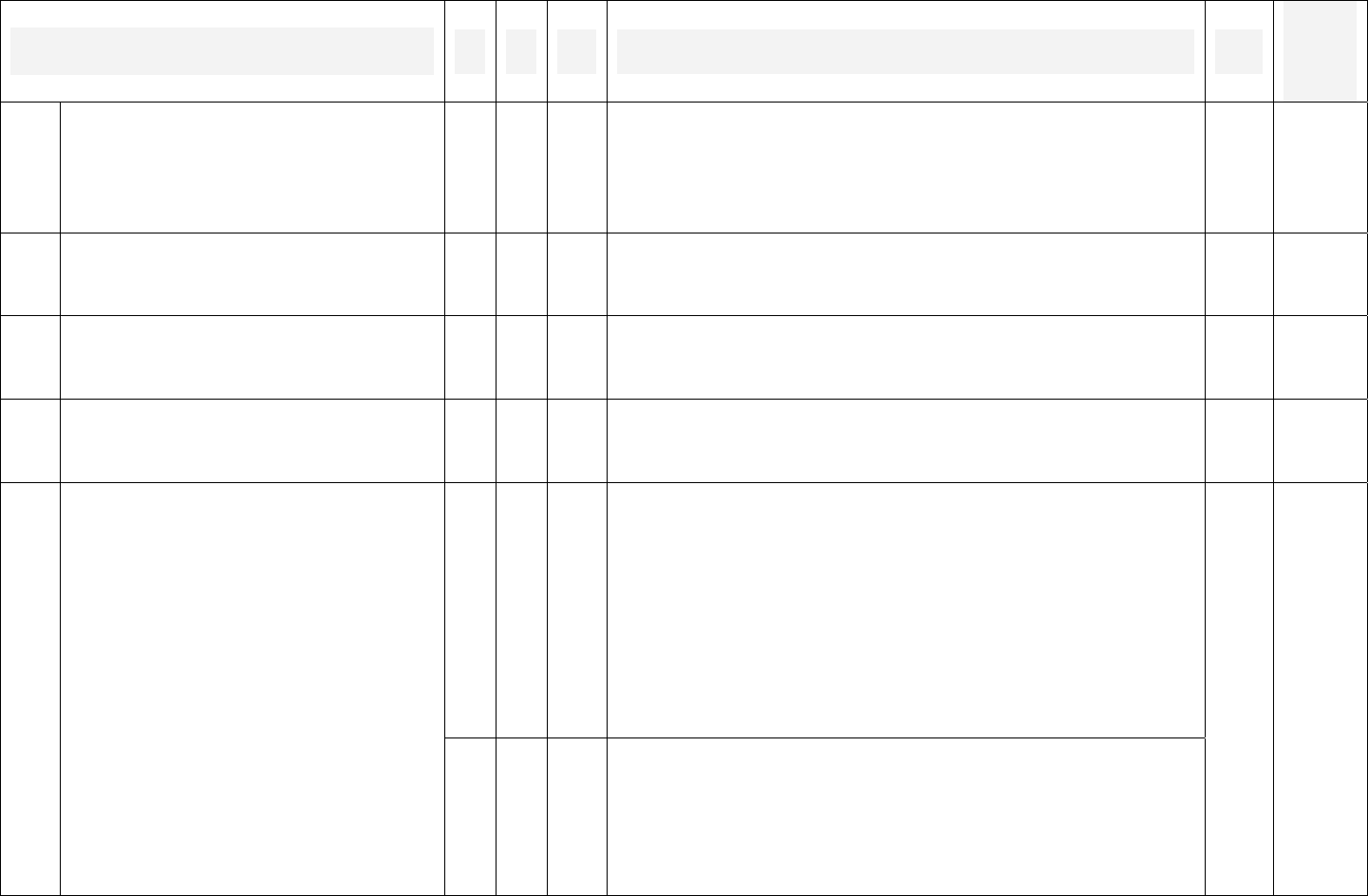

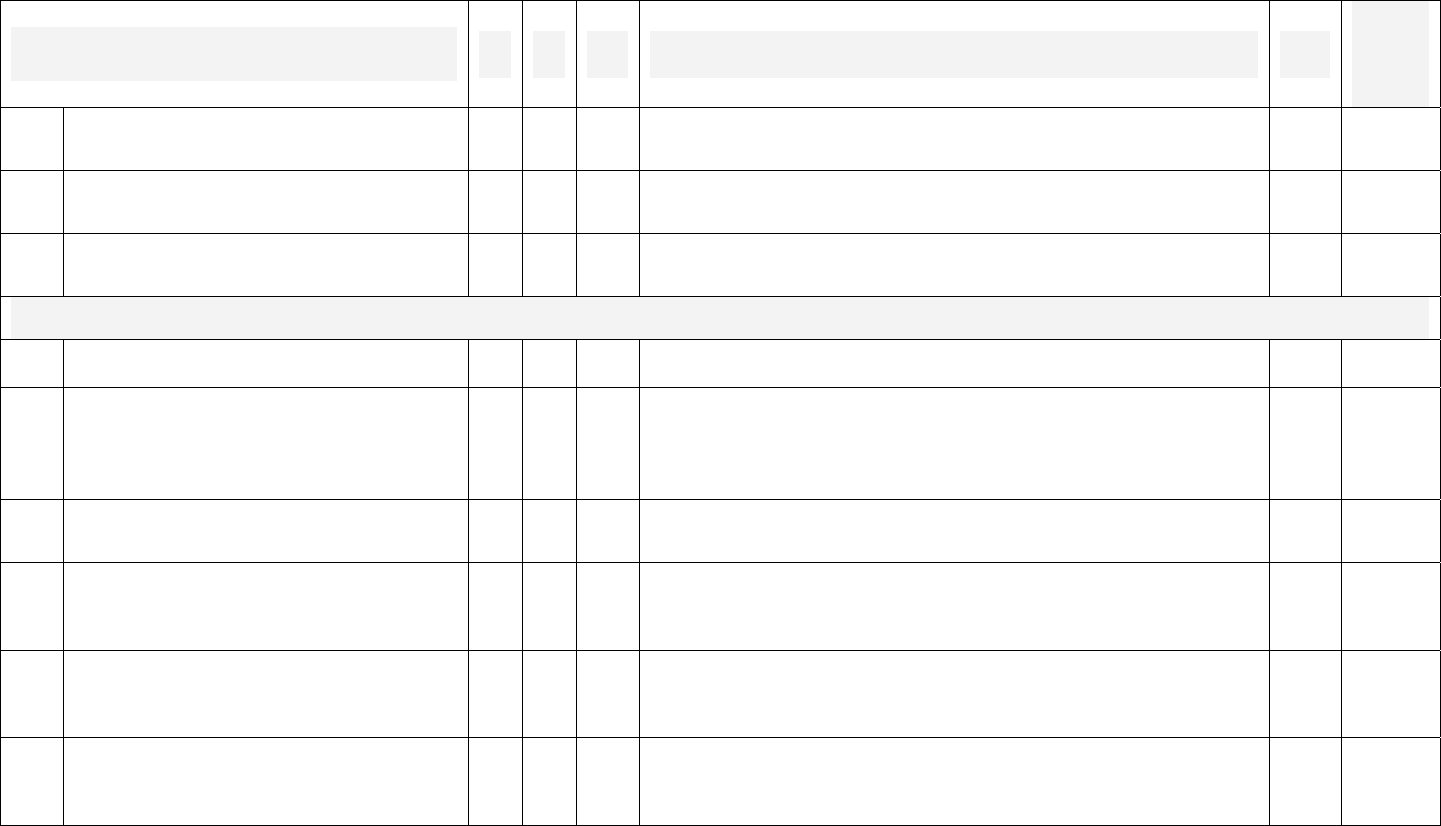

The following are four sample scenarios involving the cash reconciliation process. For

all, 26 August 2005 is “yesterday’s date,” and 27 August 2005 is “today’s date.” At the

close of business yesterday, the cash on hand at this imaginary branch was 20,500

units; that amount was carried forward to become the starting cash on hand today.

Daily cash on hand is recorded in:

• The Cash Book – maintained by the regular Cashier

• The Cash Ledger – records various cash transactions

• The Daily Cash Position - where all transactions are totaled

S

CENARIO I

From 20,500 units starting cash on hand today, the branch disbursed 2,000 in loans to

various Village Banks. The branch received no reimbursements. The transaction

reduces today’s cash on hand to a closing total of 18,500 units.

Yesterday’s closing cash on hand

/

Today’s starting cash on h

and (20,500)

-

Total amount of cash disbursed today

(2,000)

=

Today’s closing cash on hand

(18,500)

Appendix A

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

24

These transactions are documented in the Cash Book as follows:

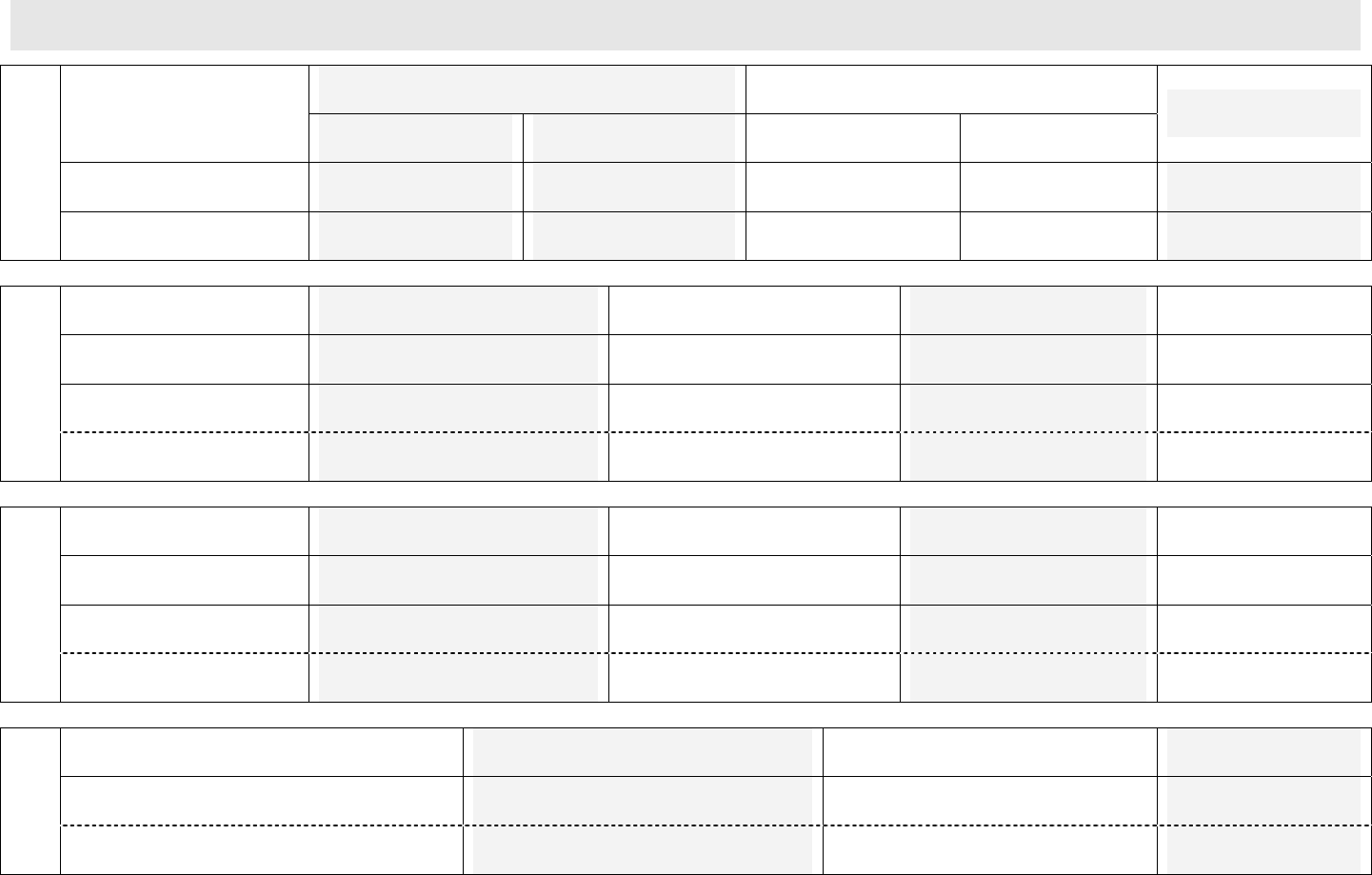

Sample Cash Book page (Scenario I)

Total Cash Balance

Date Entry

Cash IN Cash OUT

Balance

(Reimbursement) (Disbursement)

Closing cash on

08/26/05 20,500

hand today

Cash B/F from

08/27/05 20,500

yesterday

08/27/05 Today's transactions (none) 2,000 18,500

Closing cash on

08/27/05 18,500

hand today

S

CENARIO II

The starting cash on hand is 20,500 units. Today, the branch receives reimbursement

(“cash in” from clients) totaling 10,500 units. The branch conducts no disbursements

today, and so the day’s final cash on hand is 31,000 units.

Yesterday’s closing cash on hand

/

Today’s starting cash on h

and (20,500)

+

Total amount of reimbursements received today

(10,500)

=

Today’s closing cash on hand

(31,000)

These transactions are documented in the Cash Book as follows:

Sample Cash Book page (Scenario II)

Total Cash Balance

Date Entry

Cash IN Cash OUT

(Reimbursement) (Disbursement)

Closing cash on

08/26/05

hand today

Cash B/F from

08/27/05

yesterday

08/27/05 Today's transactions 10,500 (none)

Closing cash on

08/27/05

hand today

Balance

20,500

20,500

31,000

31,000

Appendix A

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

25

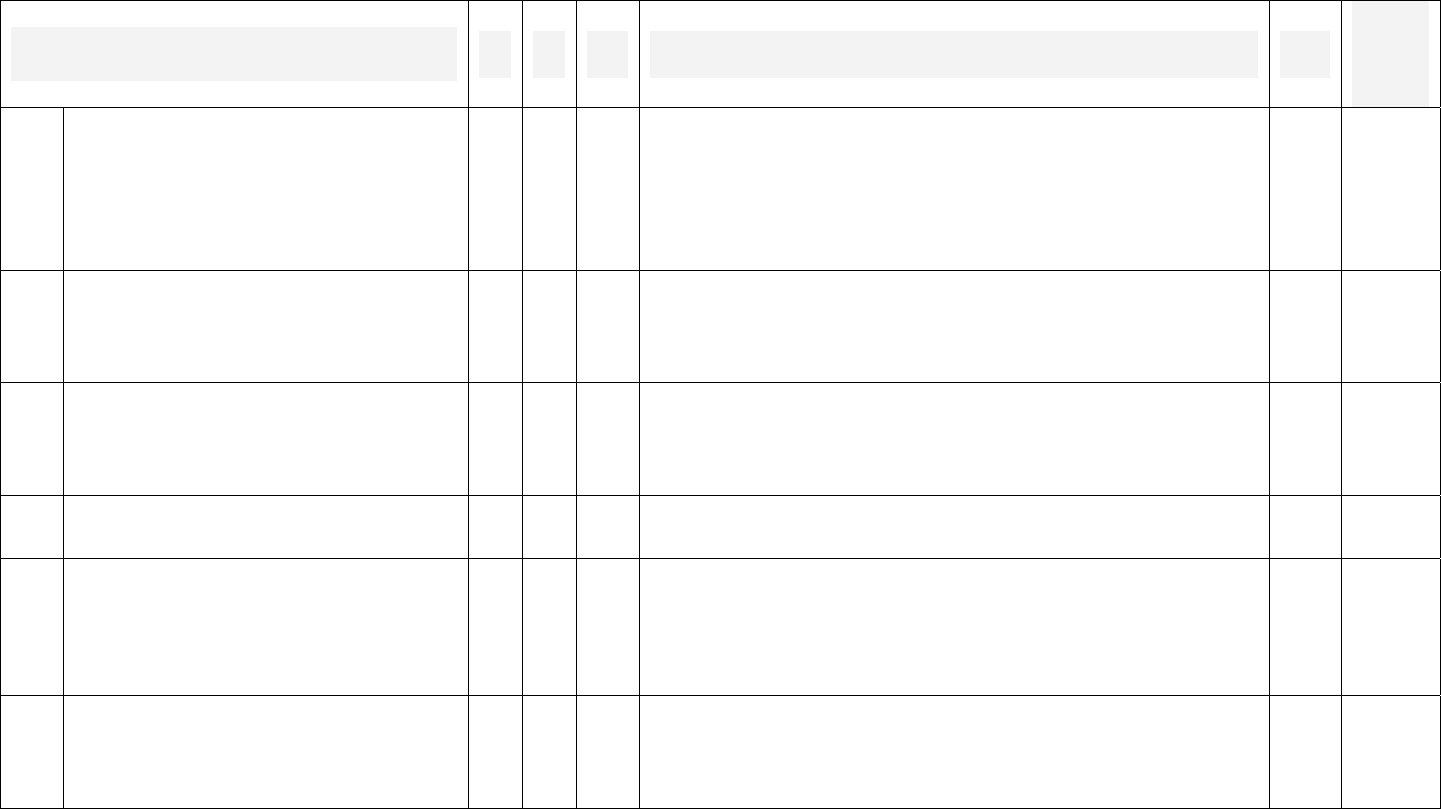

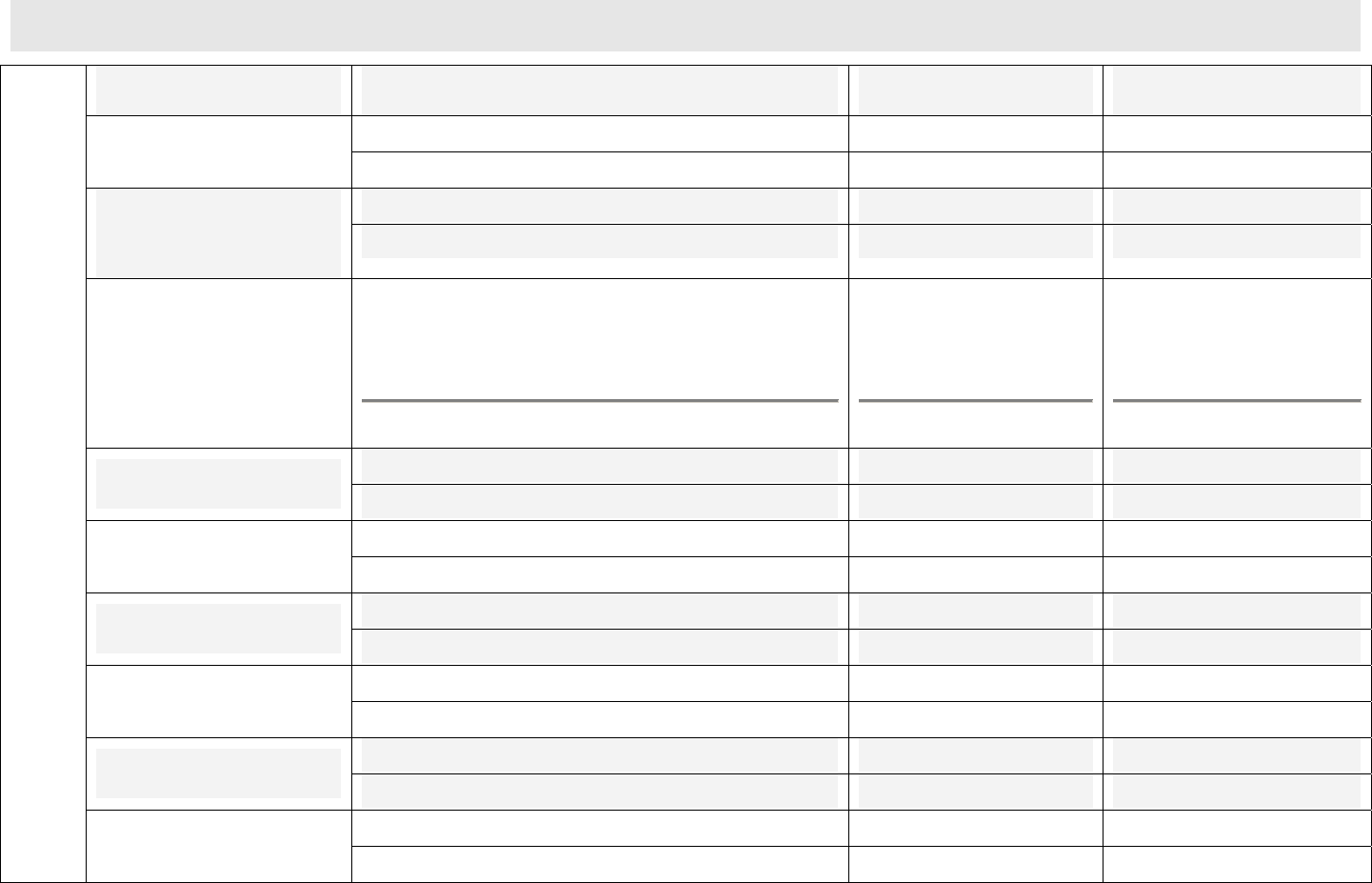

SCENARIO III

The branch’s starting cash on hand is 20,500. Today, the branch disburses 3,000 units in

loans to Village Banks, and receives 7,000 units in reimbursement. The transactions

result in an overall net cash on hand increase by 4,000 units, and a total of 24,500.

Yesterday’s closing cash on hand

/

Today’s starting cash on h

and (20,500)

-

Total

amount of cash disbursed today

(3,000)

+

Total amount of reimbursements received today

(7,000)

=

Today’s closing cash on hand

(24,500)

These transactions are documented in the Cash Book as follows:

Sample Cas h Book page (Sce nario III)

Total Cash Balance

Date Entry

Cash IN Cash OUT

(Reimbursement) (Disbursement)

Closing cash on

08/26/05

hand today

Cash B/F from

08/27/05

yesterday

Today's transactions

"Village Bank A" 2,300

"Village Bank B" 3,400

08/27/05

"Village Bank C" 1,300

"Village Bank D" 600

"Village Bank E" 2,000

"Village Bank F" 400

Today's transaction

08/27/05 7,000 3,000

totals

Closing cash on

08/27/05

hand today

Balance

20,500

20,500

22,800

26,200

27,500

26,900

24,900

24,500

4,000

24,500

Appendix A

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

26

SCENARIO IV

The branch’s starting cash on hand is 20,500 units. Today, the branch disburses no

loans and receives no reimbursements. The branch’s cash position – that is, its cash on

hand – does not change.

These transactions are documented in the Cash Book as follows:

Sample Cash Book page (Scenario IV)

Date Entry

Total Cash Balance

Cash IN

(Reimbursement)

Cash OUT

(Disbursement)

Balance

08/26/05

Closing cash on

hand today

20,500

08/27/05

Cash B/F from

yesterday

20,500

08/27/05 Today's transactions (none) (none) 20,500

08/27/05

Closing cash on

hand today

20,500

Appendix B

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

27

I

NTERNAL

C

ONTROLS

I.

C

ASH

C

ONTROLS

a. Loan Disbursement

All loan application documents must meet requirements and must be verified as going to

genuine borrowers. Only after the Credit Agent, Credit Manager and Branch Manager sign all

loan documents can the cashier release funds.

To do this, the cashier prepares and signs a disbursement voucher, and the Branch Manager

and two Credit Agents sign it in full to approve. All disbursement vouchers and receipts must be

mechanically numbered in print (not by hand) in a continuous sequence. The original

disbursement voucher goes to the Village Bank with the cash funds, and a duplicate remains in

the receipt book, kept by the cashier.

At the Village Bank meeting, the Credit Agent delivers the cash to the Management Committee

President, who counts the money to confirm its amount, signs the disbursement voucher and

returns the voucher to the Credit Agent. Loan cash is distributed only to approved borrowers

themselves.

Loans are never issued by proxy.

The Management Committee Treasurer records

the amount of loan cash received by each client, and obtains the signature or thumbprint of each

client.

When all loans are disbursed, the Credit Agent and President sign the Credit Agent’s journal to

confirm the total cash distributed. If the cash amount listed on the disbursement voucher is not

distributed in full, the remaining balance is counted and confirmed by the Credit Agent and

President. The disbursement voucher must be amended, both in figures and in words, to show

the actual amount disbursed. The Credit Agent and President sign the alteration in full. Two

Credit Agents hold the un-disbursed cash and issue a receipt for the amount to the President;

upon returning to the office they give the amount to the cashier, and receive a receipt.

The two Credit Agents deliver to the cashier the disbursement voucher signed by the

Management Committee President, and the bookkeeper makes any necessary adjustments to

the records. If for any reason a disbursement voucher or receipt is cancelled, all copies remain

in the receipt books.

No new loan disbursement will take place if there are any arrears of the principal or interest of a

client’s existing loan, in either the external account or in special loans.

b. Loan Reimbursement

Daily, the Branch Manager and Credit Manager record the amount of cash that each Credit

Agent is expected to collect. Credit Agents must ensure that they have all necessary records

and materials before departing for the Village Bank repayment meeting.

At the meeting, the Management Committee President organizes the VB members so that they

approach the table to make repayments one at a time, systematically. When this is done, the

President hands the total amount of cash collected to the two Credit Agents. All the cash is

arranged by denomination. The two Credit Agents sign a receipt for the cash, and the President

also signs.

Upon returning to the office, the two Credit Agents deliver a reimbursement report and receipt to

Appendix B

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

28

the Credit and Branch Managers. The Credit Manager ensures that all repayments are recorded

accurately, and then signs the documents and delivers them to the Branch Manager, who also

scrutinizes the details before signing. The Branch Manager sends the report and receipt to the

cashier.

The cashier receives the cash from the Credit Agents for counting and reconciliation. If all is

correct, the cash is locked immediately in the safe, and the cashier issues a receipt to the Credit

Agents. On the same day, the cashier delivers the reimbursement records to the bookkeeper.

The cashier does not have access to the records after she or he has received, counted and

balanced the cash.

The Branch Manger daily checks all entries in the Cash Book, Cash Ledger, and Daily Cash

Position, and reconciles the final balance on all three documents before initialing. He or she

also reconciles the branch’s cash on hand with the entries on those books.

The cashier records all receipts and disbursement vouchers, along with the date, who delivered

it, to whom it is issued, the number of pages, the total amount of cash it represents. Every day

the cashier reconciles the receipt books and disbursement vouchers, and signs beside the

remaining balance.

All unused receipt books and disbursement vouchers should be kept in a locked cabinet.

c. Revenue Collection

The Credit Agents, Credit Manager and Branch Manager ensure that an accurate interest rate is

calculated for every loan disbursed. If any amount of interest or principal on any loan is in

arrears, no new loans may be disbursed to anyone in the entire group.

The Branch Manager ensures that interest due is collected on the date due, and that it is

credited to the appropriate interest receivable account. The Branch Manager also prepares a

monthly statement comparing branch costs and revenues.

d. Petty Cash

The Head Office fixes the petty cash limit for each branch, and remits that amount to the branch.

Under no circumstances should branch cash be used as petty cash. The stock of petty cash

should be kept up so that it is never depleted. Petty cash is released only if the person receiving

it gives a signed receipt.

The bookkeeper records daily petty cash in and out. The Credit Manager reconciles the petty

cash balance daily, as does the Branch Manager weekly on an irregular schedule.

The cash box should be locked in the safe overnight.

e. Client Savings

The Branch Manager ensures client savings records are kept accurately, and that clients

observe the compulsory savings requirement. The Branch Manager also ensures that client

savings cash is recorded in the Cash Book, Cash Ledger and Daily Cash Position records.

II. W

HERE

M

OST

F

RAUDS AND

F

ORGERIES

O

CCUR

Loans to “ghost clients” (fraudulent identities);

Appendix B

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

29

Loans distributed by proxy;

Loan capital being shared between borrower and staff;

Credit Agents using loan collections for personal use with the intent to pay them back later;

New loans granted to hide arrears;

New loans taken to pay other loans;

New loans taken to cover the compulsory savings requirement;

Payment of non-existent bills;

Theft of client savings by staff or Management Committee members;

Multiple loans to the same individual (within one Village Bank, using multiple names, or at

multiple Village Banks using the same or multiple names); or

Staff thefts.

III. M

INIMIZING

F

RAUDS AND

F

ORGERIES

Assume that anyone can be tempted to commit fraud. Be aware of sudden, inexplicable,

unplanned or unexpected significant increases or decreases in a portfolio. Assume intelligence

in the design and cover of the act. Follow every suspicion to its conclusion. Regularly rotate

staff at all levels, including the Credit Manager. Pay and treat your staff well, and be firm, fair

and impartial in your dealings with staff. Operate with zero tolerance for frauds and dishonesty.

Adhere to documented procedure and policy strictly and without lapses to discourage staff from

taking advantage of gaps in protocol. Document all procedures, policies, and systems to ensure

that each duty and responsibility is explained fully in writing.

If you do not have sufficient time to check a document properly before you sign it, do not sign it.

Do no sign any vouchers unless all supporting documents are attached. Always have the

person preparing, the person checking, and the person approving any voucher sign it. Always

write number amounts in both words and figures, and leave no space to add more figures.

Maintain separation of duties – for example, a cashier should not handle accounting, or have

access to accounting records.

Obtain as much information possible about a client, including a photograph, before the first loan

is disbursed. Have more than one Credit Agent attend disbursement and reimbursement

meetings. As a part of your internal auditing duty, visit several clients to confirm with them the

amounts they borrowed, and that that information confirms the records. Outside of your auditing

duties, occasionally talk to clients, and even to non-clients: you may receive helpful information.

All records should be written clearly and in ink, and access to all records must be restricted to

authorized staff only.

Appendix B

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

30

IV. C

OST

C

ONTROLS

Reuse items and materials as much as possible. Only essential items should be purchased,

and are to be approved by Head Office and fit within the branch budget. Prior to the purchase of

any items, at least three different price quotations must be obtained. Exceptions to that

procedure for

only the following

expenditures:

• Rent paid according to the current lease

• Fuel and oil for vehicles, motorbikes, and generator

• Water and electric utilities

•

Minor

vehicle or motorbike repairs

• Small office supplies such as pens, pencils or notebooks

• Photocopies

As often as every quarter, review the number and type of branch staff positions in relation to the

total number of clients, the total branch portfolio and number of Village Banks, to determine

whether the staff may be excessive.

When considering a proposed new Village Bank site, always take into consideration the distance

from the branch office. A motorbike ride of more than one hour likely exceeds acceptable costs

in fuel, time and security of cash or staff in transit.

Control the expenditure of office supplies, particularly computer supplies, and restrict the use of

vehicles and motorbikes to branch business only. Likewise, monitor access to telephones so

that personal expenditures to the branch are minimized; one staff member may be designated to

place all outgoing calls. Ensure that the branch’s fixed assets – such as computers and furniture

– are protected.

From cycle to cycle, monitor changes in loan size, the number of active clients, and the increase

or decrease of the branch portfolios; the number and size of loans affects overall costs.

Training is essential for continued growth and sustainability of a branch, but ensure that

trainings are relevant to staff development and do not unduly inhibit productivity.

If a consultant must be hired, the need must be clearly defined in advance, and the individual’s

cost and credentials verified and reconciled to the branch budget. Hiring and training of new

staff is also expensive. Whenever possible, senior management – a CEO or COO – should sit

down with a staff member who declares his or her resignation in order to determine if he or she

might be persuaded to stay.

Appendix C

CHECKLIST FOR AN INTERNAL AUDIT 31

Credit Inspection Internal Audit Report

(Page 1 of 2)

B

RANCH

N

AME

:

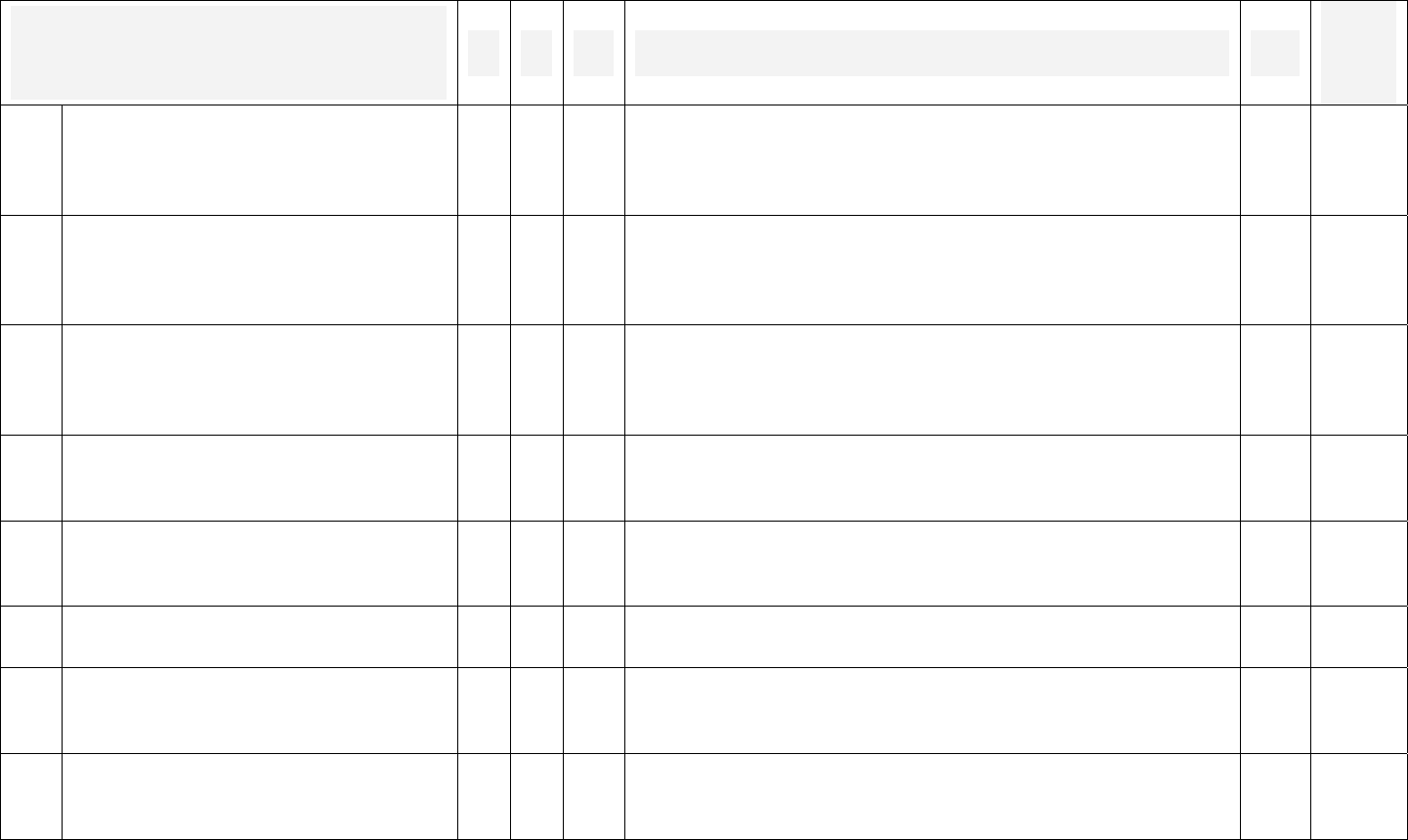

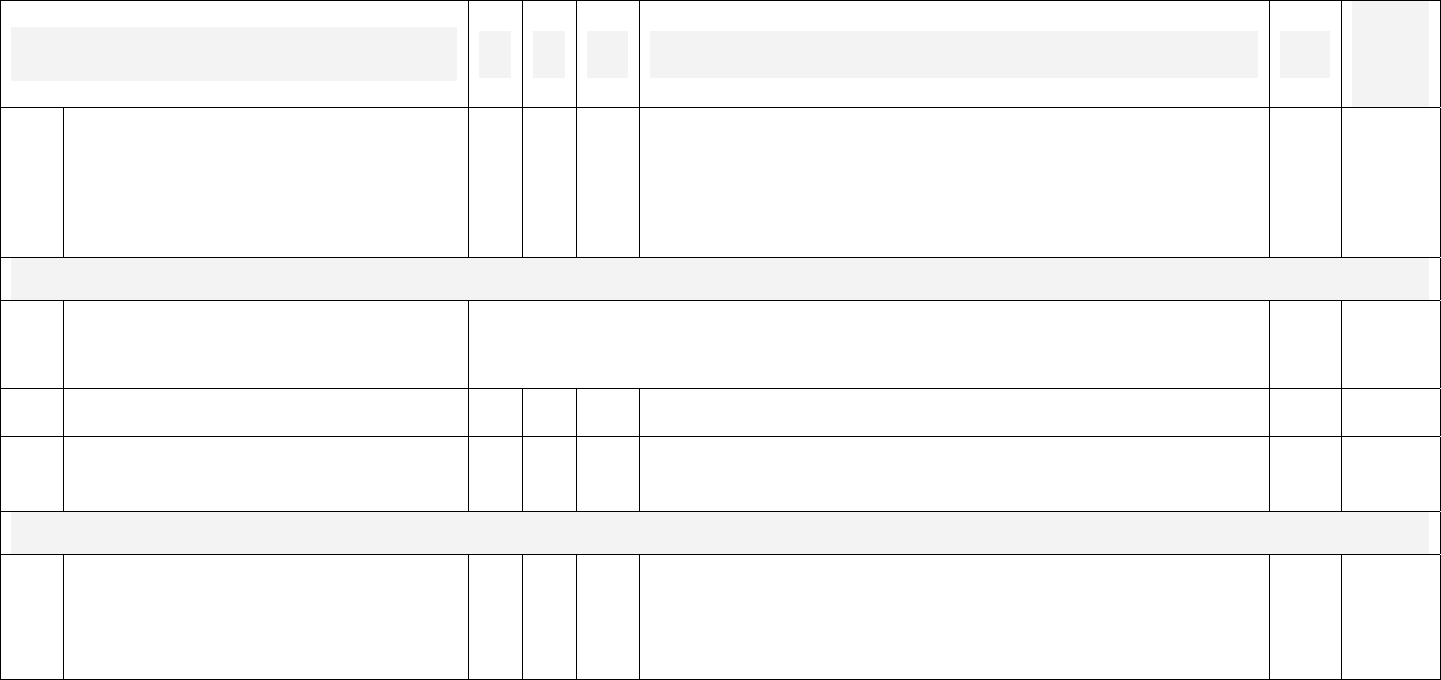

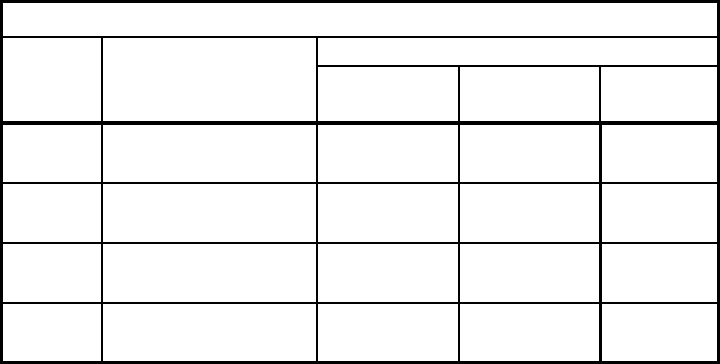

Ratings key:

Please make your assessments by percentage point (to be totaled and compared).

Excellent: 100%

Good: 90% or better

Satisfactory: 80% or better

Unsatisfactory: Less than 80%

Evaluation Categories

Previous

Audit

Current

Audit

1

The branch conducts client baseline surveys prior to choosing a Village

Bank site.

Gauge how much information is gathered, how it is gathered, how the

information is analyzed, whether the branch adequately uses the

information, etc.

2

The branch promotes client business plans that in the auditor’s opinion

are intelligent and attainable.

3

New Management Committee members

properly trained.

and Village Bank members are

4

Client thumbprints or signatures appear on all loan contracts.

5

Loan approval policies and procedures are strictly and consistently

followed.

6

Loan disbursement procedure is strictly and consistently followed.

7

The growth rate in the

acceptable.

loan portfolios is in the auditor’s opinion

8

Less than 1% of portfolios are at risk in one calendar year.

9

Overdue debts are written-off for the year in which they occur.

10

Reimbursement records are free from arrears on

loans

any external or internal

11

The collection of arrears occurs with prompt and continuous action.

12

Interest due the

consistently.

branch is calculated accurately and collected

13

Client files are properly protected.

14

Client drop-out is recorded and monitored.

Overall Total

Appendix C

CHECKLIST FOR AN INTERNAL AUDIT 32

C

REDIT

A

UDIT

I

NSPECTION

S

UMMARY

(Page 2 of 2)

1. This credit inspection of ________________

(branch name)

commenced on

__________

(date)

and was completed on __________.

2. Based on percentage assessments in the fourteen control categories, the

branch achieved an overall performance rating of _______ percent for the

current year.

3. The current audit rating of _______ percent is an improvement / decline

(circle one)

from the overall rating of the previous audit.

4. Improvement or decline is noted in the following areas:

5. In order to improve its overall credit rating, the branch should ensure that all

irregularities identified by this audit report are corrected. The following are

suggested actions toward noted shortcomings:

The Branch Manager acknowledges the content of this report, and has discussed

any concerns with the auditor. Any items of disagreement between the Branch

Manager and the auditor regarding this report are to be documented in an attached

list.

Please check one

:

See attached list

No disagreements noted

Signed, Date:

______________________________ __________________

Branch Manager

______________________________ __________________

Internal Auditor (or Internal Audit Manager)

Appendix D

CHECKLIST FOR AN INTERNAL AUDIT 33

F

INANCIAL

S

ERVICES

I

NTERNAL

A

UDIT

R

EPORT

(P

AGE

1

OF

2)

B

RANCH

N

AME

:

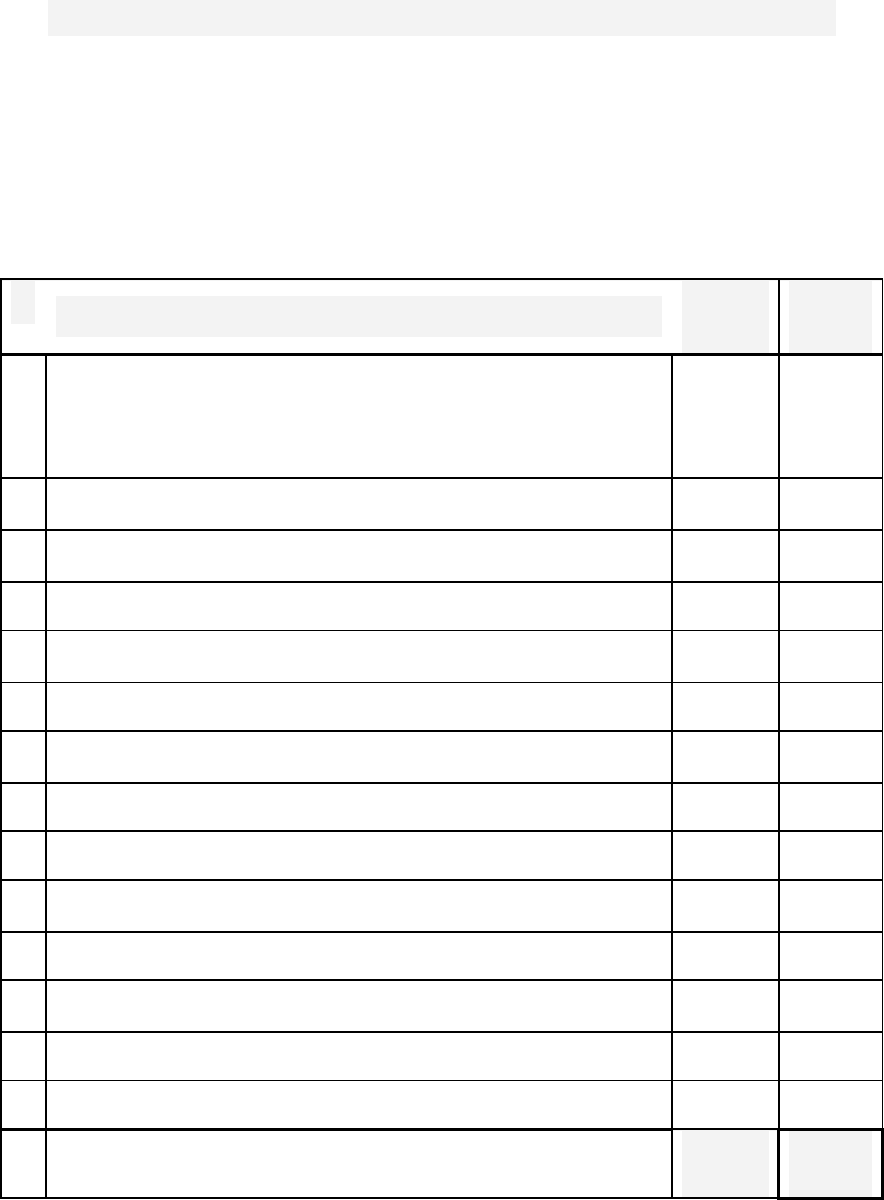

Ratings key:

Please make your assessments by percentage point (to be totaled and compared).

Excellent: 100%

Good: 90% or better

Satisfactory: 80% or better

Unsatisfactory: Less than 80%

Evaluation Categories

Previous

Audit

Current

Audit

1

Personnel policies and active procedures are consistent.

2

Supervision of staff is adequate and in the auditor’s opinion

effective.

3

Administrative policies and active procedures are consistent.

4

Accounting policies and active procedures are consistent.

5

In the auditor’s opinion, the branch’s

effective.

internal controls are

6

Expenses, costs and income are traceable and reasonable.

7

Daily and weekly cash reconciliation and

consistent.

records-keeping is

8

Communication between management and staff is in the auditor’s

opinion effective.

9

Cash and fixed assets are protected.

Overall Total

Appendix D

CHECKLIST FOR AN INTERNAL AUDIT 34

F

INANCIAL

S

ERVICES

I

NSPECTION

S

UMMARY

(Page 2 of 2)

6. This credit inspection of ________________

(branch name)

commenced on

__________

(date)

and was completed on __________.

7. Based on percentage assessments in the fourteen control categories, the

branch achieved an overall performance rating of _______ percent for the

current year.

8. The current audit rating of _______ percent is an improvement / decline

(circle one)

from the overall rating of the previous audit.

9. Improvement or decline is noted in the following areas:

10. In order to improve its overall credit rating, the branch should ensure that all

irregularities identified by this audit report are corrected. The following are

suggested actions toward noted shortcomings:

The Branch Manager acknowledges the content of this report, and has discussed

any concerns with the auditor. Any items of disagreement between the Branch

Manager and the auditor regarding this report are to be documented in an attached

list.

Please check one

:

See attached list

No disagreements noted

Signed, Date:

______________________________ __________________

Branch Manager

______________________________ __________________

Internal Auditor (or Internal Audit Manager)

Appendix E

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

35

J

OB

D

ESCRIPTION FOR AN

I

NTERNAL

A

UDITOR

Working Relationships

Under direction of the Internal Audit Manager, an Internal Auditor (IA) coordinates and

communicates closely with branch staff, the Branch Manager, Credit Manager, and with

managers in the Head Office. The IA must also work closely with Village Bank

Management Committee members, clients and village leaders to obtain information

relevant to the confirmation of branch records and operations.

Job Statement

Reporting directly to the Internal Audit Manager, the IA is responsible for systematically

examining all of a branch’s financial transactions to ensure the accuracy and adequacy

of accounting records and systems, and to locate and identify discrepancies, if any.

Duties and Responsibilities

1. To check the branch’s adherence to personnel management and

administrative policies;

2. To check branch compliance with accounting and internal control protocol by:

• Confirming authorization for cash disbursement and office expenses;

• Scrutinizing accounts classification;

• Scrutinizing cash handling procedures;

• Confirming a separation of duties such as prohibits opportunities for fraud;

• Confirming the safekeeping of cash and files; and

• Assessing the adequacy of staff volume to the branch’s current level of

business.

2. To verify balances in client savings, external accounts, and internal accounts

at three levels. The IA ensures the accuracy of Village Banks’ financial

records in Credit Agents’ journals and reports, in Management Committee

documentation, and in clients' passbooks.

3. To check the branch’s adherence to procedures for Village Bank meetings

and financial records-keeping, and aptitude in transferring skills and

knowledge to clients.

4. To ascertain the existence and true value of accounts by:

• Counting and reconciling cash on hand with the Daily Cash Journal;

• Confirming balances of inventories, loans, repayments, etc;

• Scrutinizing the rate of aging on receivables; and

• Confirming account value information with creditors and debtors.

Appendix E

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

36

5. To check allocated budgets against actual expenditures to report any

discrepancies;

6. To check the inventory list and depreciation schedule. The IA will confirm that

the branch’s assets agree with its official inventory list, and that its fixed

assets are accurately and consistently depreciated;

7. To discuss the audit process with branch management and staff prior to

conducting it, and afterward to clarify initial findings and recommendations;

8. To prepare audit reports; and

9. To ensure the branch’s compliance of audit recommendations.

Terms of Work

For an IA to be effective and efficient in fulfilling the duties of the position, he or she must

be provided with computer/technical assistance, training opportunities to continually

upgrade his or her financial auditing knowledge, and relevant support and direction from

the Audit and Finance Committee of the Board of Directors.

Minimum Competencies for an Internal Auditor

• Financial auditing experience, preferably within a financial institution;

• Working knowledge of financial planning, including budgeting and

accounts projection;

• Ability to prepare external and internal financial statements;

• Ability to detect and interpret patterns in financial data;

• Ability to assess and improve financial systems and procedures;

• Familiarity with accounting and auditing procedures generally;

• Excellent spreadsheet analysis skills;

• Attentiveness to detail, ability to manage multiple tasks and meet

deadlines;

• Supervisory experience and ability to be impartial;

• Interest in helping the poor and marginal sectors of society;

• Character of integrity and honesty;

• Ability and willingness to identify frauds and forgeries;

• Excellent communication skills in written and spoken English.

Appendix F

C

HECKLIST FOR AN

I

NTERNAL

A

UDIT

37

S

INGLE

-

AND

D

OUBLE

-S

TARRED

C

HECKLIST

I

TEMS

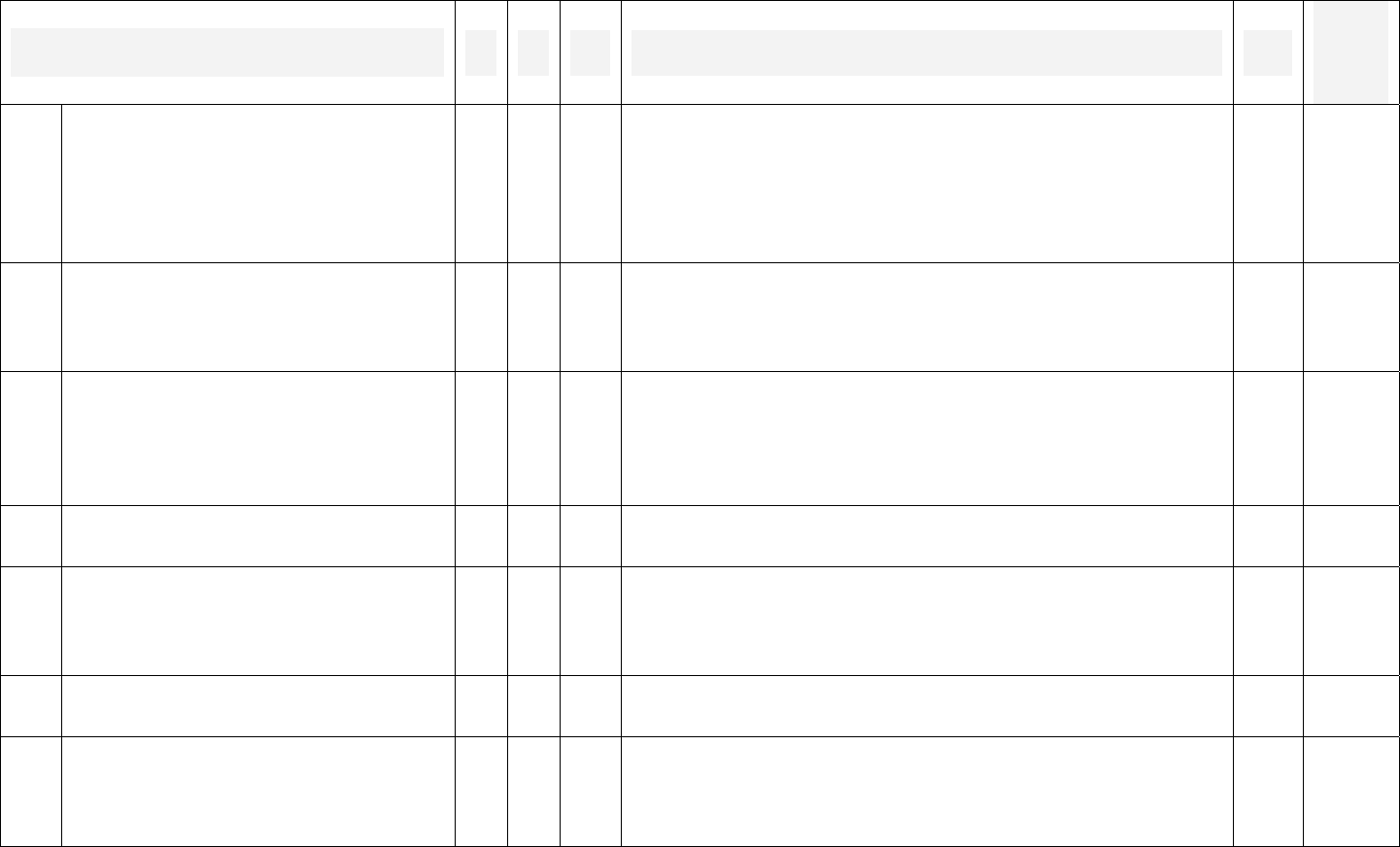

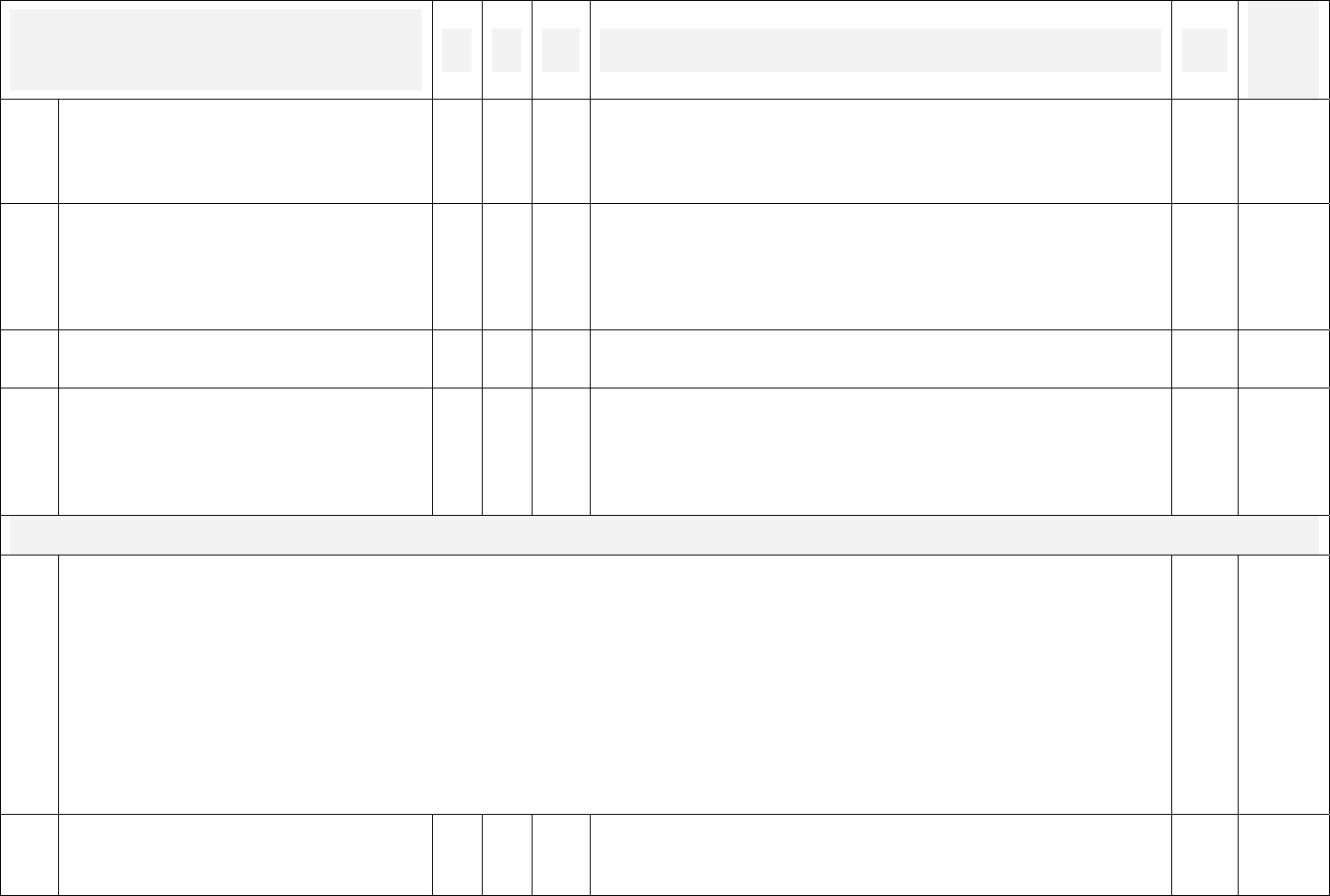

As referred in the Introduction, some items in the checklist are marked with either a

single (*) or a double (**) asterisk. The following is a consolidated list of these especially

important points.

*

Checklist

number

If your answer is “no,” the issue

requires urgent remedial action.

5

Are all doors and windows well

secured to prohibit forced entry?

6

Are at least two different keys

required to unlock the building’s

doors?

8

Is the strong room secured to

prohibit forced entry?

9

Is the safe fixed to the wall or floor to

prevent its removal?

14

Do duplicate safe keys and

combinations exist?

15

Are there written procedures to

access the duplicate keys and

combinations?

16

Are receipts kept whenever duplicate

keys or combinations leave or enter

the safe?

24

When a receipt is cancelled, are all

three copies left in the receipt book?

28

Is the branch cash limit observed?

29

Did you undertake a random check

of at least 50% of all cash

transactions in the cashbook to

confirm that the entries are correct?

46

Are all vehicles and motorbikes fully

insured and licensed?

**

Checklist

Number

If your answer is “no,” the issue

denotes a critical situation.

7

Are at least two different keys required to

unlock the strong room (safe room) door?

10

Do safe custodians issue receipts for all cash

received, and are copies of those kept in the

safe?

11

Are all changes of custodian for safe key and

combination, and the date and time of each

change, recorded in a register?

12

Are the safe key and combination held

separately at all times by senior staff?

13

Do outgoing and incoming safe custodians

sign next to the change entries?

17

Is the safe opened only in the presence of

more than one custodian?

18

Before the safe is opened, are the main door

and the door to the strong room locked?

19

Are all cash movements to and from the safe

recorded in a cashbook?

20

Are entries in the cashbook and on receipts

recorded in both figures and words?

21

Do the figures and words in all entries

agree?

26

Does the total cash count reconcile with the

recorded total in the cashbook, the cash

journal and in the daily cash position

register?

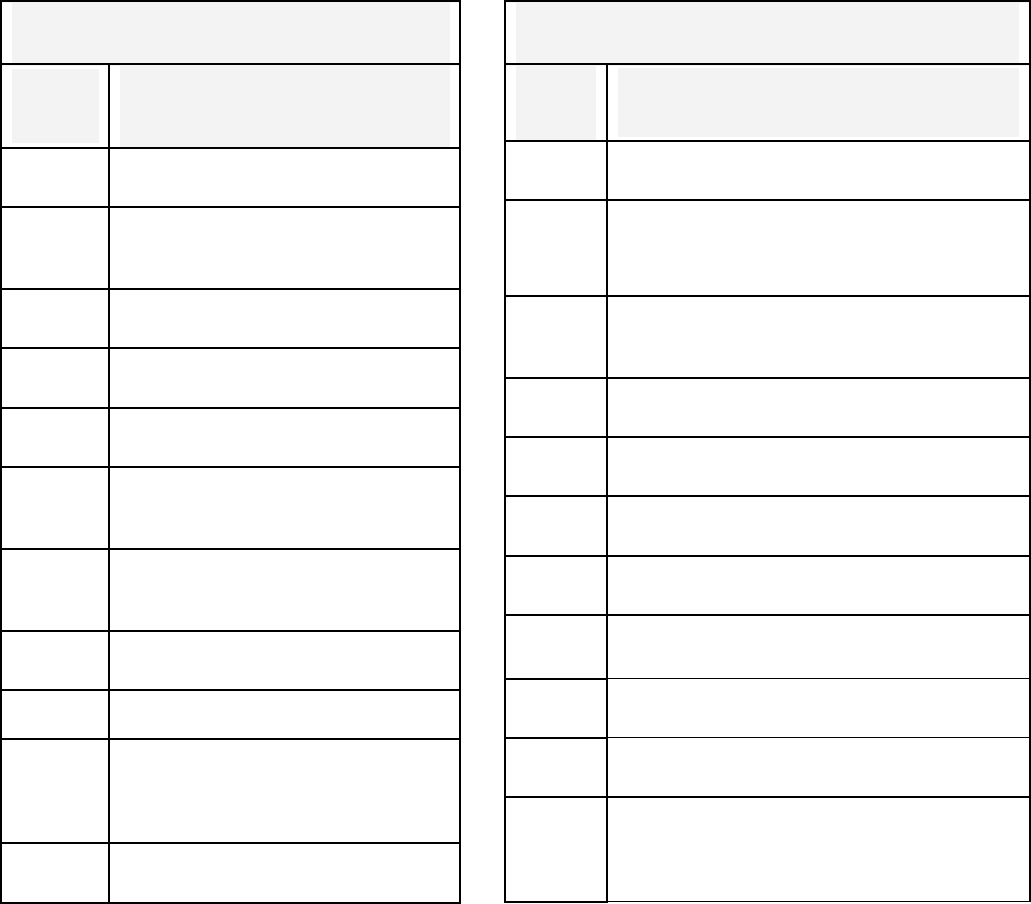

Catholic Relief Services founded in 1943, assists the poor and

disadvantaged outside the United States. CRS works in solidarity with all

people of good will and similar vision to promote human dignity, alleviate

human suffering, promote the development of people, and foster charity,

justice, and peace in the world. CRS assists the poor solely on the basis of

need, not creed, race, or nationality, and maintains strict standards of

efficiency and accountability. CRS currently operates in 99 countries and

territories and supports microfinance activities in 29 countries.

,

CRS Microfinance

South East Asia

Cambodia

East Timor

Indonesia

Philippines

Thailand

Europe

Armenia

Bosnia-Herzegovina

Bulgaria

Croatia

Macedonia

Latin America and the

Caribbean

Ecuador

El Salvador

Guatemala

Haiti

Nicaragua

Peru

West Africa

Benin

Burkina Faso

Ghana

Niger

Senegal

Eastern Africa

Ethiopia

Uganda

Middle East and North Africa

Egypt

Jerusalem, West Bank, and Gaza

Morocco

Turkey

South Asia

India

Pakistan